Yarm Explained: Turning Trust and Tweets into Yield

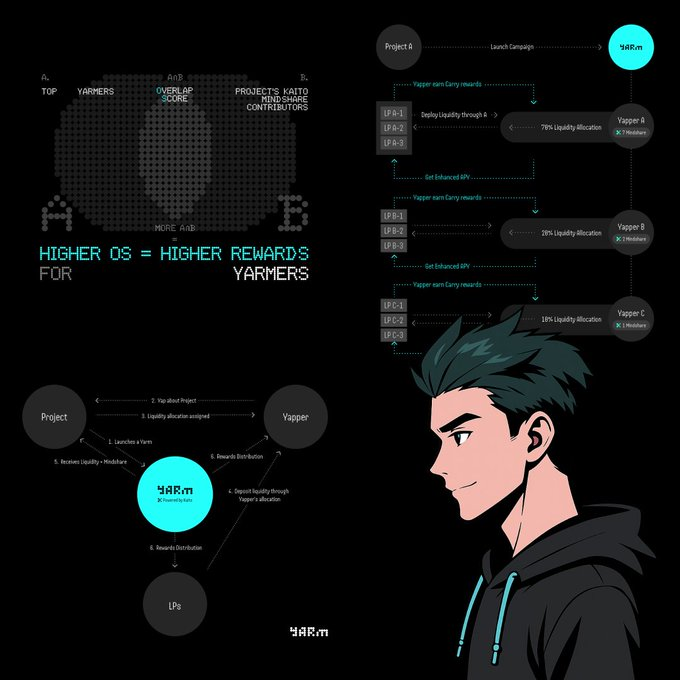

tl;dr: Yarm is a new platform by Mitosis and Kaito AI that turns social influence into onchain yield. Yappers earn Mindshare by posting about projects, and Liquidity Providers back top Yappers and earn yield based on their performance.

A project’s Overlap Score boosts APY for everyone. DeFi meets SocialFi with attention = access & influence = capital. Yap well, get paid. Back the right yap, earn more.

Mitosis and Kaito AI have joined forces to launch Yarm, a socially-driven liquidity platform where influence powers capital. Built on Mitosis’s Ecosystem-Owned Liquidity and enhanced by Kaito’s SocialFi data, Yarm connects content creators (“Yappers”) with Liquidity Providers, allowing social trust to drive early-stage access and yield.

Yappers earn allocations based on their “Mindshare,” while LPs back those voices and earn yield based on their performance. The Overlap Score tracks influencer engagement on new projects—boosting APY as attention rises.

More than just a concept, this is a fully backed collaboration. Yarm is where programmable DeFi meets social capital, aligning incentives across builders, influencers, and investors.

Yarm launched their website and they finally revealed what it's all about. Yarm is shaping up to be the next big InfoFi play—but with a twist. In traditional InfoFi, content creation (aka “yapping”) turns into rewards.

Yarm takes this a step further by connecting two key players: Yappers and Liquidity Providers. Together, they form a new kind of onchain social-financial engine.

Here's how it works: If you're a Yapper with strong influence and trust on platforms like X, Yarm tracks your "Mindshare"... the metric that reflects how much attention you command. A high Mindshare earns you early access allocations when new projects launch on Yarm.

Liquidity Providers can then deposit into these allocations, and you earn a share of the rewards based on performance. This flips the script: instead of capital holders taking all the upside, influential voices get rewarded too—aligning social capital with financial capital.

Liquidity Providers benefit too; the more impact a Yapper has, the more attention a project receives, and the higher the APY they can earn. The core metric behind the scenes is the Overlap Score, which measures how much a project is being discussed by top Yappers.

The higher the score, the higher the potential APY—so everyone is incentivized to amplify projects together. Yarm is merging trust, influence, and liquidity into a smarter, more aligned financial layer for Web3.

Residual Income:

Claim your Zerion XP!

Sonium: Sake Fi / Kyo / Arkada / Algem / Untitled Bank

AI Agents & Mindshare: Kaito / Theoriq / FantasyTop

Play2Earn: Splinterlands & Holozing

Foarte complicat.

!BBH

Hmmm, this doesn't for for me at all. Not Twitter popular enough.

!BBH

Depends how good you are on Twitter/X.

!BBH

!BBH