Using Bitcoin to Borrow USDT to Buy HBD - 12 days later...

At the beginning of the month I borrowed $1,000 USDT using $2,000 of BTC as collateral on CoinRabbit.io and converted the USDT into 1000 HBD. At the time, Bitcoin was around $109,000.

That transaction helped me climb onto the fourth rung of my "HBD Freedom Ladder" as I reported here:

https://onebitcoinclub.org/hive-125568/@hirohurl/6k-another-step-up-the

So today, 12 days later, I'll explain more about WHY I took this loan and the current state of play. None of this is investment advice, simply an account of what I've been up to with my crypto so far this month...

HBD Freedom Ladder

I've explained this in previous blog posts, but briefly, my goal is to accumulate 120,000 HBD. At 20% p/a that would pay out 2,000 HBD per month in interest. At the current 15% p/a you'd still get 1,500 HBD per month.

Bitcoin is a Deflationary Asset

When I created the ladder I imagined that I'd sell Bitcoin for HBD to help me climb the ladder. The problem with that approach, however, is that Bitcoin is a deflationary asset while stable coins tied to the US dollar are not, and we are relying on the yield (20% or 15% p/a) to keep us ahead of inflation.

With that in mind, it makes more sense to use Bitcoin as collateral to set up a loan and use the loan to buy into HBD.

Since HBD earns 15% p/a with monthly yield payments, the interest you pay on a crypto loan is largely covered, as I'll show later in this post.

Hedging Against Volatility

Of course, there is also some risk involved in this kind of loan. Let's say you deposit $2,000 worth of Bitcoin into a loan account when Bitcoin is priced at $100,000, and borrow $1,500, using your Bitcoin as collateral. You have borrowed 75% of the value of your collateral. That gives you a margin of safety of 25% - actually, more like 23%. You then buy 1,500 HBD with your loan.

If Bitcoin suddenly drops to $76,000, the lender will liquidate your loan. You will lose your Bitcoin. However, you still have your 1,500 HBD, though the purchase proved rather expensive!

On the other hand, if you only borrow 50% of your collateral rather than 75%, your margin of safety is much greater, and if the price of Bitcoin goes up, your margin of safety increases even more.

So I wouldn't borrow more than 50% of my collateral. Also, I would not want to borrow when Bitcoin is hitting new all time highs, as it was a couple of days ago...

It also makes sense to keep some Bitcoin in reserve, so that if the price of Bitcoin does suddenly drop you can always top up your collateral from your Bitcoin reserve to get your collateral back into the margin of safety. I suggest that you use no more than 25% of your Bitcoin as loan collateral, and borrow against no more than 50% of your collateral.

As you pay off your loan, your safety margin continues to increase, and your interest costs also decline.

In short, I see this approach as a good way to increase my HDB assets without decreasing my Bitcoin assets.

Coin Rabbit Loan Progress Report 1

Okay, now let's have a look at how things are progressing with my loan...

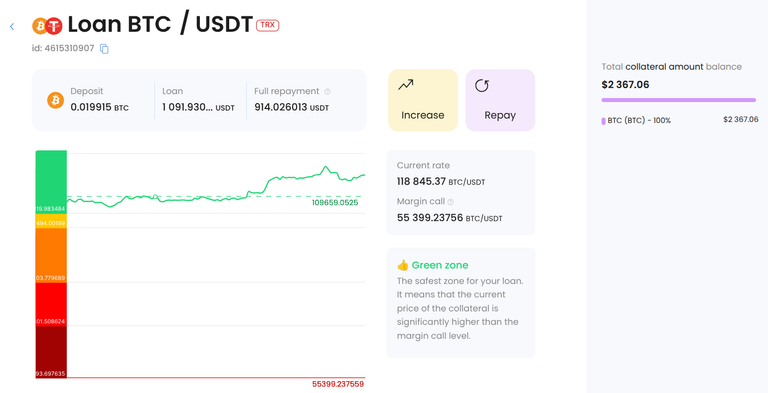

On 4th July I deposited $2,000 worth of Bitcoin on CoinRabbit.io and used it as collateral for a $1,000 USDT loan that I used to buy 1,000 HBD, as I mentioned.

At that time Bitcoin was around $109,000. The loan plus fees was 1,092 USDT and the interest rate was 15.469008% per annum, or $14.08 per month.

On the other hand, 1,000 HBD was around $1,000, and the yield 15%, or $12.50 per month.

On 5th July I was able to repay 193.37301 USDT, bringing down the outstanding loan to 914.026013 USDT.

Here's the state of play, 12 days later:

Now Bitcoin is around $118,000, and my collateral has therefore risen from $2,000 to $2,366, while the outstanding loan is around 914.03 USDT and the interest rate 15.469008%, or $11.79 per month.

That means my 1,000 HBD, which yields 15%, or $12.50 per month, is now earning MORE than the current monthly interest cost of the loan!

That being the case, I will continue to reinvest my monthly HBD yield into HBD savings, and slowly pay off the loan with a large chunk of my monthly affiliate commissions that are paid in Bitcoin... Of course, as Bitcoin is a deflationary asset, I don't want to spend 100% of my monthly commissions on repaying the loan - I will keep adding a portion of those earnings to my Bitcoin bottom line.

And in due course, it will be time to think about rinsing and repeating the process to help me climb the HBD Freedom Ladder without selling off my Bitcoin assets.

Cheers!

David Hurley

#InspiredFocus

P. S. One way to accumulate free Bitcoin is with FreeBitcoin.io 😉

Interesting though the interest rate of 15% is quite high, no?

Compared to what?

!BBH

!ALIVE

Banks charge 3-6% per year if you lend longterm Money there, Credit cards or if you stretch your Account they charge you 12-15% per year, not month.

Ah, I think I see where the misunderstanding comes from. I wrote:

I've now edited that to clarify that the interest rate is the yearly rate:

"the interest rate was 15.469008% per annum, or $14.08 per month.

UK credit cards currently charge an exorbitant 35%, and US credit cards are closer to 20% I think.

!BBH

Ah now it makes Sense. 15% on a yearly base sounds ok for such a deal though I think they will get cheaper once competition rises

It is a complex plan you have to follow to succeed your mission.

Wish you all the best of luck

Happy saving in HBD

Complex? Not really. Borrow on one site, swap on another site. Lock up as HBD savings on Hive. Job done!

!ALIVE

!BBH

Thank you

I didn't know there were places willing to give loans on BTC. Very cool!

I was up to $2k in my HBD savings, but I couldn't resist trading most of it for Hive when it dipped below .20. If Hive ever gets back up to $1 or more, that will prove to have been a good move. But, if we stay around this level for another few years... Well, time will tell, eh?

There's a bunch of sites that offer loans on BTC, but most require KYC. CoinRabbit doesn't. It's been around for 5 years or so.

!ALIVE

!BBH

Fascinating ... and how wonderful for you ... the rise in Bitcoin fell out just right, and that interest rate fell in perfectly!

Yes, the timing was quite nice - the rise in Bitcoin, and my paying off a bit of the loan have increased the margin of safety...

!ALIVE

!BBH

That's some excellent asset leveraging that you've got going on there, David! I'm impressed! Kudos on your success so far! 😁 🙏 💚 ✨ 🤙

Thanks @tydynrain - so far, so good! 🤞

!ALIVE

!BBH

You're very welcome, David, of course! I look forward to hearing how it goes! 😁 🙏 💚 ✨ 🤙

!ALIVE

!BBH

Congratulations @hirohurl! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 6000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks for the great info

You're welcome!

!BBH

!ALIVE

Is this the infinite money glitch?!

I am keen to simulate this on paper later.

Do you have to pay gas fees for sending your bitcoin over?

Also what’s the assurance they will always give you back your bitcoin later?

I think the infinite money glitch = put your loan into bitcoin mining and use the bitcoin to pay back the loan and rinse and repeat...

Gas fees - yes

Assurance? Fingers crossed and touch wood. I just checked Trust Pilot and CoinRabbit is on 4.3

https://www.trustpilot.com/review/coinrabbit.io?page=4

!ALIVE

!BBH

Ohe this literally took a while for me to get my brain on understanding what you are doing here.

And I do get it but for some reason it still sounds like this could glitch anytime? But as the price of btc rises, the price that you have to pay per month drops right?

Soo...what happens when btc drops to say 90K and you lending fees will not be made up for with the HBD interest you get in every month?

There's no fixed monthly repayment. The volatility of Bitcoin is part of the risk - and the opportunity. I think the trick is to pay a chunk of the loan off early.

!ALIVE

!BBH

Hbd > usdt 🐝

Email verification almost impossible on the freebitcoin site☹️

Btw, Nice write up. Learning to understand all this finance talk