The SUSD Stablecoin Saga: What Really Happened?

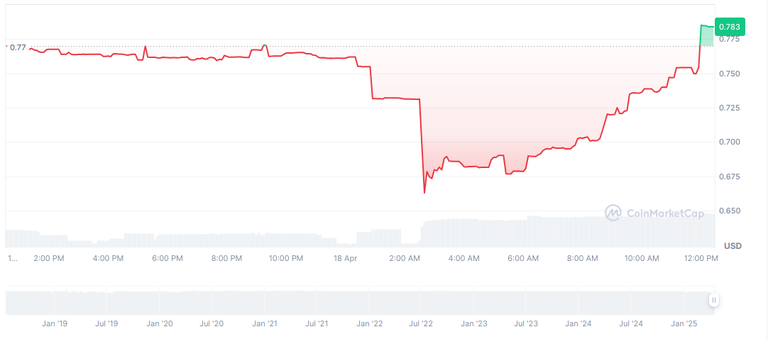

In the fast-evolving world of decentralized finance (DeFi), stability is a prized commodity — and stablecoins are meant to provide exactly that. But what happens when a stablecoin loses its peg and trust begins to erode? That’s precisely what unfolded with Synthetix’s SUSD, once considered a reliable dollar-pegged asset in the Ethereum ecosystem. Over time, cracks started to appear, raising questions around liquidity, collateralization, and the long-term viability of the token.

The SUSD story isn’t just about one stablecoin — it’s a cautionary tale about how complex mechanisms, shifting market dynamics, and community governance intersect. The situation has stirred debate across DeFi forums and left many wondering: What really went wrong? Was it a protocol flaw, poor market conditions, or something deeper? And most importantly, what’s being done now to steer SUSD back on track?

If you're involved in crypto, DeFi, or just curious about how digital finance deals with instability, this is one story worth your time.