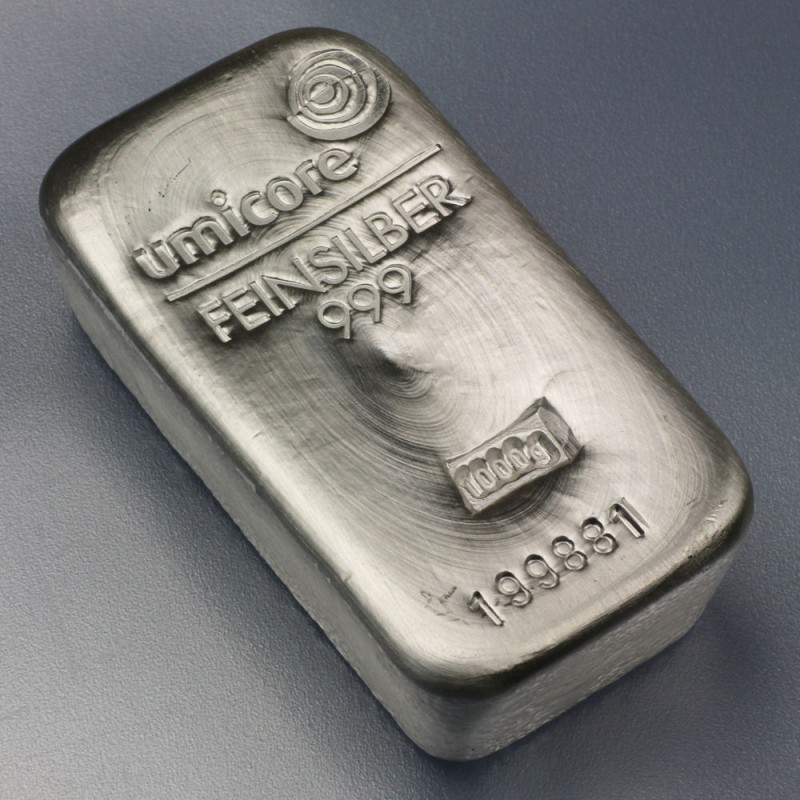

PAAS the silver powerhouse

Hello my fellow finance interested people here on HIVE

Today I want to write a little about one of my favourite investments of 2025 and beyond: Pan American Silver (ticker PAAS).

As investors seek stability and upside in an increasingly volatile market environment, precious metals (particularly silver) continue to play a vital role in diversified portfolios. Among the major producers, Pan American Silver Corp. (NYSE: PAAS) stands out in early 2026 as a company combining operational strength, financial resilience, and growth momentum. Recent production updates and forward‑looking guidance highlight why Pan American Silver is drawing interest from both institutional and retail investors.

Pan American Silver delivered a robust operational year in 2025, exceeding its silver production guidance with 22.8–22.84 million ounces of attributable silver produced. The company also reported record fourth‑quarter output of approximately 7.3 million ounces, largely fueled by the recently acquired Juanicipio mine in Mexico. But not only silver, also gold is an important asset of this company. Gold production reached 742,200 ounces, aligning with guidance and contributing meaningfully to overall revenue diversification.

Pan American closed 2025 with an impressively fortified balance sheet. Cash and short‑term investments stood at roughly $1.319–1.32 billion, marking a substantial increase—more than $408 million—from the previous quarter. Additionally, available liquidity reached $2.07 billion, supported by an undrawn revolving credit facility.

Pan American's share price reacted positively to its operational success, climbing significantly through 2025. According to market research, the stock has increased 171.8% year‑over‑year, outperforming many peers in the precious metals sector.

Analysts at Simply Wall St highlight that Pan American’s valuation still leaves room for potential upside, with some fair‑value estimates suggesting the stock may be undervalued by as much as 40–66%, depending on metal price assumptions and capex efficiency.

The opportunity comes with a risk as well. Namely volatile precious metals prices, rise in operating or capital costs or operational disruptions, like an accident in a mine.

Nevertheless PAAS is still on my buy-list but everyone should decide for themselves if they want to go for that investment.

!HBIT

!UNI

!BEER

!BBH

eii, you mined 0.9 🟧 HBIT and the user you replied to (sylmarill) received 0.1 HBIT on your behalf as a tip. You can receive 100% of the HBIT by replying to one of your own posts or comments. When you mine HBIT, you're also playing the Wusang: Isle of Blaq game. 🏴☠️ | tools | wallet | discord | community | daily <><

What's more, you found 1.0 ⚪ BLAQ pearl as a bonus treasure token!

Your random number was 0.060383426152309294, also viewable in the Discord server, #hbit-wusang-log channel. Check for bonus treasure tokens by entering your username at block explorer A, explorer B, or take a look at your wallet.

There is a treasure chest of bitcoin sats hidden in Wusang: Isle of Blaq. Happy treasure hunting! 😃 Read about Hivebits (HBIT) or read the story of Wusang: Isle of Blaq.

!BBH

!UNI

!LOLZ

!ALIVE

View or trade

BEER.Hey @sylmarill, here is a little bit of

BEERfrom @eii for you. Enjoy it!We love your support by voting @detlev.witness on HIVE .

View or trade

BEER.Hey @sylmarill, here is a little bit of

BEERfrom @eii for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.