CPI Data

Last week may have been one of the most critical macroeconomic weeks of the past few months.

Unemployment fell, jobless claims declined, and inflation cooled.

So… is the Fed cutting rates? Not so fast.

Because when we look a bit deeper into the numbers, we realize the picture is more complex. It is neither clearly bullish nor clearly bearish. It is, let’s say, a transitional phase.

LABOR MARKET

Let’s start with the labor market, because traditionally that is the first thing the Fed looks at.

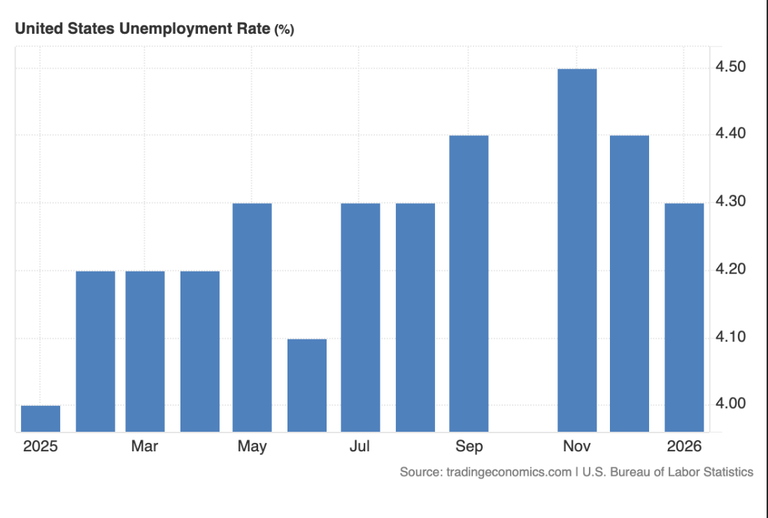

The United States added 130,000 new jobs in January, more than double expectations. At the same time, unemployment declined to 4.3%. On its own, that signals resilience.

But that is not all.

Initial jobless claims fell to 227,000. That was slightly above the 222,000 consensus, but lower than the previous week. So we seem to be seeing stabilization.

Meanwhile, labor force participation rose to 62.5%. More people are reentering the workforce. That suggests mobility, confidence, and a sense that “there are jobs out there.”

So far, the picture shows a labor market that is holding up well.

CPI

Now let’s move to the most important part of the week.

Inflation, measured by the Consumer Price Index, came in at 0.2% month over month, lower than analysts’ expectations of 0.3%.

On an annual basis, inflation stands at 2.4%, below the 2.5% the market expected and down from 2.7% in December.

Truth be told, this was a surprise that not many were expecting.

Core CPI, which excludes food and energy, rose 0.3% on a monthly basis, exactly as expected, while on a yearly basis it came in at 2.5%, slightly lower than the previous month.

What does this mean in practical terms?

It means inflation is moderating, but it has not yet broken below 2%.

So what is still keeping inflation elevated? Let’s look at the components.

Energy fell 1.5% during the month, which significantly helped the headline number. Shelter, the largest component of CPI, increased just 0.2%. That is very important, because markets were worried that rents would accelerate again. Meanwhile, airline fares jumped 6.5%, and transportation put pressure on core CPI. At the same time, we saw declines in used cars, down 1.8%, and in certain insurance categories.

In short?

We are not seeing a broad resurgence of inflation.

FED

So now the question is, what will the Fed do?

The Fed is in a very delicate position.

On one hand

- The labor market is resilient

- Wages are rising 3.7% annually

- We are not seeing an increase in unemployment

On the other hand

- CPI is moderating

- Shelter prices are softer

- Energy is helping

So what does it do?

At the March meeting of the Federal Reserve, the most likely outcome is no change in interest rates, because there is no reason to rush.

If it cuts too early and the economy reaccelerates, inflation could return. And that is the last thing it wants.

At the same time, if CPI continues to cool over the next few months, the pressure for rate cuts will increase.

⚠️⚠️⚠️ ALERT ⚠️⚠️⚠️

HIVE coin is currently at a critically low liquidity. It is strongly suggested to withdraw your funds while you still can.

Sending Ecency love your way, thanks for using Ecency.