Why HBD Is the Best, Most Decentralized Stablecoin You've Never Heard Of

The signing of the Genius Act into law by President Trump has been accompanied by the widespread adoption of stablecoin technology. It has moved faster into the game, and now the United States government is looking to establish its control and dominate over it through the laboratory framework of regulation.

Yeah, yeah, and yes again, we have heard those words about making crypto usable, stabilizing the cryptocurrency so it can power the economy, create a workable environment for crypto firms and stablecoin companies like Tether to thrive without worrying much about regulatory problems from the government.

But pause to think for a second! As this even created safe assurance for stablecoins, when you are still required to go through all that smile before the camera, nod your head to the KYC requirement while signing up, or is there more doubt about the government being able to regulate the stablecoin you choose to purchase?

Well, the only way to find out is through your cash. Will it get frozen, restricted, or, above all, asked a bunch of questions about it? Now, let's talk about the regulation of stablecoins. Why are there still questions about wanting a stablecoin that has the following requirements:

- is not tied to fiat

- is not regulated in any way

- cannot be frozen or stopped by tyrants

- does not require AML KYC to use

It only speaks to one thing, and that is the curiosity of crypto users, and you have not heard about HBD (Hive Backed Dollar). To better understand what HBD is, one has to know what a stablecoin is.

Stablecoin

In the words of Investopedia, stablecoins are cryptocurrencies that derive their value from other financial instruments. In simple terms, crypto that is pegged to the price of a financial instrument. For example, tether's USDT is pegged to the price of the dollar, which means 1 USDT is equal to $1.

Stablecoins were created due to the volatility that comes with cryptocurrencies like BTC, ETH, and others, and the establishment of these stablecoins has proven to be helpful in cross-border payments. Recently, the Nigerian Securities and Exchange Commission (SEC) held a conference about the regulations of stablecoins since their use has grown immensely, and even banks rely on stablecoins for cross-border payments.

With a little understanding of what a stablecoin is, it should not be hard to put it together that the Hive Backed Dollar token, known as HBD on Hive Blockchain, is a stablecoin. HBD is pegged to the Dollar, and it was created by Hive and Hive is a community built on censorship resistance. The community comes with its blockchain technology that has created a stablecoin that takes away the problem of being controlled like other centralised stablecoins: USDT and USDC.

As long as USDT and USDC remain controlled by the companies that established them and are now regulated, there will always be a requirement for KYC before using them or purchasing them. That is just one of the drawback that comes with centralised stablecoins.

And that is where HBD comes in. It is entirely decentralized. No KYC needed, governmental control, and you do not have to worry about it getting frozen. It is a standout member of the stablecoin party, unlike its centralised counterparts, where these worries are valid.

If that is not enough to tickle your fancy, it takes out the worry of most degens or crypto traders and users. Take this: there is a 15% APR per annum, you get on your HBD. I guess you have to let me know when centralized stablecoins offer this APR.

The fast 3-second transaction speed is also worth consideration, but I am not hung up on that when there are lower transaction fees thanks to resource staking. I cannot have my eyes on the pretty lady at the bar when ETH is killing me with gas fees. I remember dumping the tokens I wanted to swap off back in 2022 when I saw the gas fees were a whole lot more compared to the actual value of the token.

You may have concerns about what the parameters are on HBD; they are here and simple:

- There is a 30% limit. When you buy up to 30% of the token's market capitalization, no more for you.

- Big companies and players with high liquidity have to purchase HBD by buying the HIVE and vice versa. This increases the value of the community token and, in return, lowers the debt ratio. More Hive tokens than HBD.

- Users on Hive get HBD through the reward pool, which helps in the supply of the token.

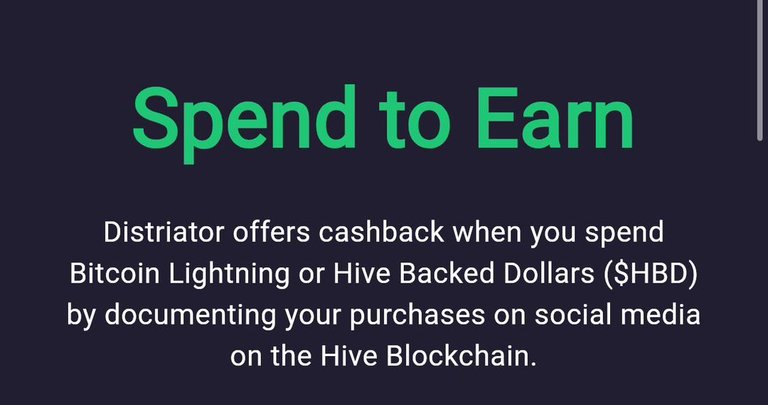

Another point in supporting the use case for HBD is the spending and earning with distriator. Distriator allows you to spend HBD and get cashback on your HBD spent. It is as simple as that. A use case for your crypto.

Take it or leave it, Hive may not have the worldwide brand appearance that many are looking for, but the use case speaks more to its relevance. You do not have to be completely sold on promotion, but you know when something meets its parameters.

For more details on HBD, you can check out chapter 17.5 in this post:

Chapter 17. Algorithmic Stablecoins on Layer 1

cover photo created using AI

Unlike USDT and USDC that requires kyc and regulated by the government because they are centralized stable coins , HBD is totally the opposite and that makes it unique..not to talk of its interest rate when staked, wit no transactions fee..

HBd is such a stablecoin in the hive blockchain that stands out..

Yes I agree. Just need more people to know this.

HBD was 20% APR, and it was off limit for someone like myself here in the USA. I simple wasn’t sure how to navigate the on an off ramps and the possible liabilities.

I think HBD is a great stable coin and Hive is a great blockchain (of course the chess community is great).