Tell me what you think…

(Edited)

It’s one of the Key Dates…

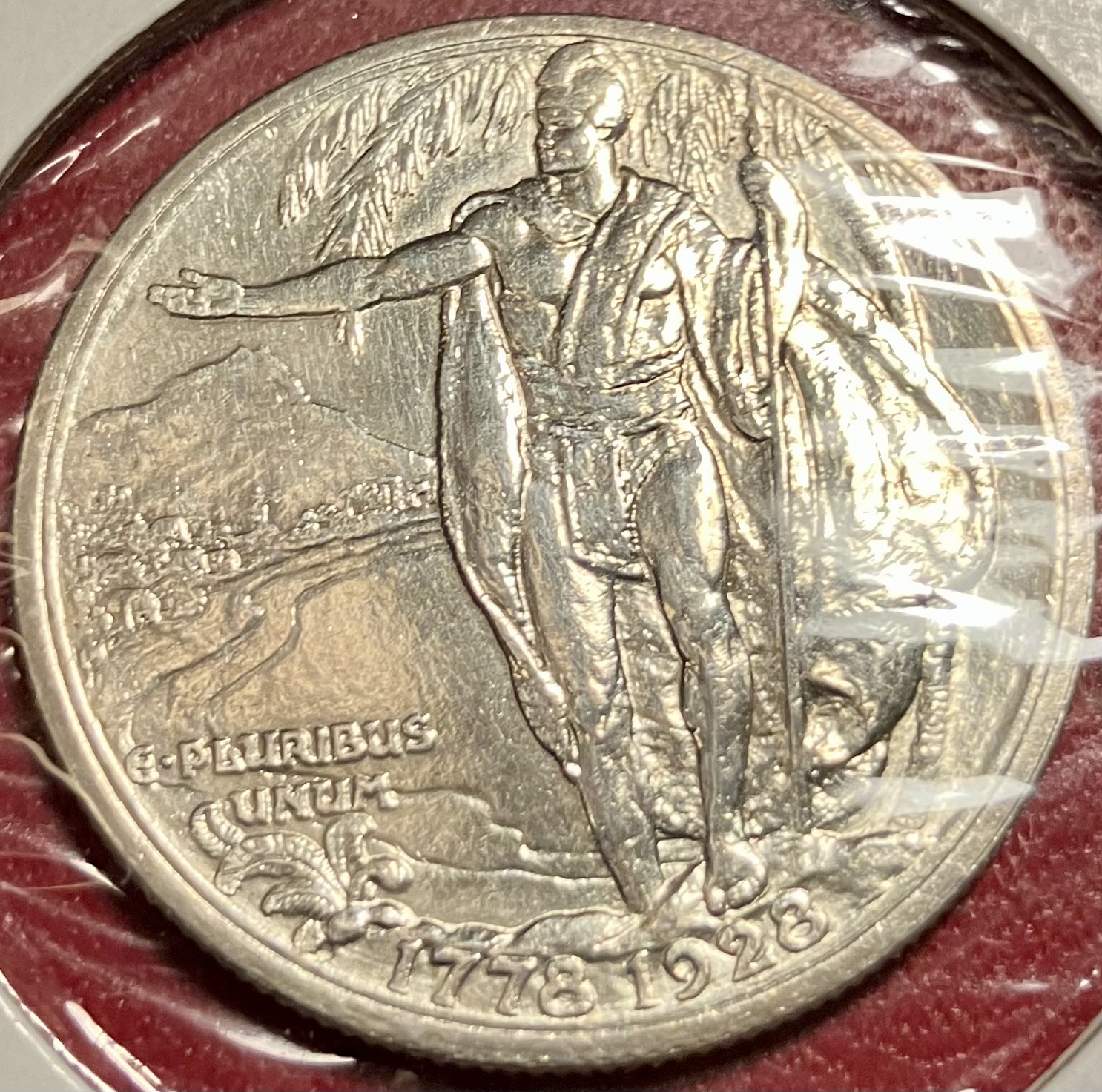

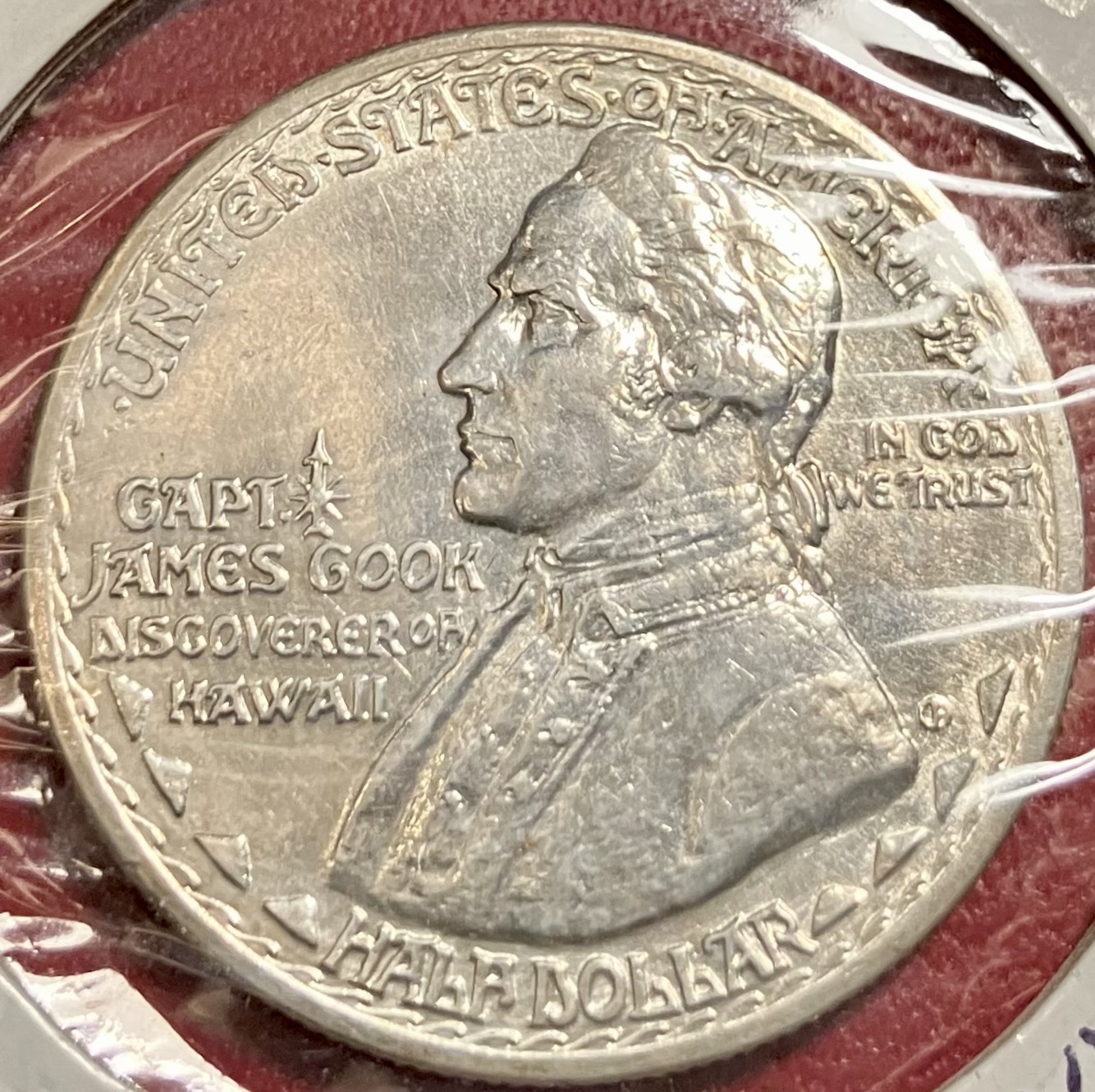

The 1928 Hawaiian Half Dollar…

Anyway…

I have come a long way since I first started writing about the U.S. Monetary Correction…

I tried to make it work with our Original Silver and Gold Coins an quickly figured out we were Bamboozled by Agents working for the Bankers of the day…

I’m sure the Agents sounded very intelligent as they convinced us why we should use confusing Weights, with Face Values on our Coinage that were Set too low…

I figure we’ve been suffering from that mistake, starting with the Coinage Act of 1792…

Do any of my long time readers think I’m onto something…???

Feel free to question anything I post…

0

0

0.000

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Your point about the Coinage Act of 1792 feels like the root of it. Locking face values while metal prices move made the good coins vanish and the junk stay, classic good-money-goes-away stuff. If you had your way, would you float face value with spot or ditch face value and make coins pure weight units, so no one needs a slide rule to buy bread? The idea is solid, the daily use is the puzzle.

Our Silver Coins will have $1, $2, $5 and $10 Face Values…. Our Gold Coins will have $10, $20, $50 and $100 Face Values…. The Silver Coins will back our Silver Certificates denominated in Cents, and our Gold Coins will back our U.S. Stable Coinage, denominated in Electronic Dollars, Cents and Decimal Cents…. Our Commn Coinage will be Grandfathered into our New Product Line of Stable Coinsge…. Our Silver and Gold coins will contain 1/10 , 1/5, 1/2 and 1 ounce of Silver or Gold…

I like the clarity, but how do you keep coins in circulation when melt value climbs past face value—do you adjust face values, change metal content, or offer on-demand redemption at spot minus a small fee to close the arbitrage? Are the silver certificates and the electronic dollars both redeemable for metal on demand with audited reserves and tight spreads, and who sets the spot price you honor? How exactly do you grandfather existing coinage without creating two prices for the same unit in daily use? Also, what’s your plan for decimal cents when metals jump fast, so payouts and change don’t get messy?

The Melt Values of our Silver and Gold Coins will remain at least 10% below the Coins Face Value… Our Silver and Gold Coins won’t Circulated as much as our Common Coinage, Silver Certificates or our Electronic Coinage, because if their huge amount of Spending Power…. Our smallest $2 Silver Coin will have the Spending Power of 200 of todays Fiat USD’s… The Face Values of our Gold Coins will remain stable and that’s why I picked Gold Coins to 100% back our Electronic Coinage… Silver Coins will need their Face Values adjusted in Phase Two and Phase Three of the Reset, but that will be down the Road… This means that in Phase Three, One Ounce of Silver will be worth Two Ounces of Gold… Our Common Coinage will mostly be used here in the States… They will have the same Spending Power as our Silver Certificates… Our Silver Certificates will be used to “remove and replace” Federal Reserve Notes all over the World, at a 100 to 1 Exchange Rate... This was the main reason they will be denominated in Cents instead of Dollars… Yes, you’ll be able to redeem our Common Coinage, Silver Certificates and Electronic Coinage for an equal Face Value of Silver and Gold Coins… This tells me, $10 in Common Coinage can be turned in for a One Ounce $10 Silver Coin… By the way…. If you’re currently earning 50 Fiat Dollars per hour, it will be Reset to $0.50 per hour in Electronic Coinage… To figure “after reset” prices, just divide todays Fiat prices by 100 to arrive at the New Sound Money prices… I’m still open to more questions… I also have more than a thousand posts to help you understand…

Phase Three has me scratching my head: did you mean one ounce of silver equals two ounces of gold, or the other way around. If gold coin face values stay fixed while silver coin faces adjust later, and everything redeems 1:1 by face, what stops a free arbitrage trade swapping between gold and silver coins during the shift. On the 100:1 reset, will every wage, price, tax, rent, mortgage, bank deposit and bond coupon be divided by 100 on day one, and how do you handle rounding and contract disputes. For foreigners, how will FX desks quote the new Electronic Dollar and what backstops keep offshore dollar IOUs from triggering a run on your gold reserves during the swap.

You need to number your questions…lol…. I’m not sure where to begin…. Not many people will have knowledge about a Phase Two or Three… In Phase One, the Silver/Gold Ratio will be Set at 10 to 1…. Phase Two will be Reset to a 1 to 1 Silver/Gold Ratio…. Phase Three will be Reset again to a 1 to 2 Silver/Gold Ratio, meaning One Ounce of Silver will get me Two Ounces of Gold… During phase Two and Three, people will be able to turn in their Silver Coins for New Silver Coins with the New Face Values… The Silver Coins not replaced, will become “Collector Coinage”… A good rule of thumb about the 100 to 1 Reset is to divide Pre Reset Values by 100 as a srarting point to arrive at Post Reset prices…. Paper Dollars will get the full 100 to 1 Reset amount in Silver Certificates, but Digital Dollars in Insured Bank Accounts will only be insured up to $2,500 in Electronic Gold… During the Redemption period we will be using “both” Fiat Dollars and Sound Money Dollars…. It may take a while, but we will eventually remove and replace all Fiat Dollars in circulation… Some things can’t be done in a single day… There’s only one way to obtain “New” Electronic Gold and that will be with Gold… People will always have the option of turning in their Electronic Gold for Gold Coins…. I’m not worried about runs on the Banks because Electronic Gold and “Circulating” U.S. Gold Coins will be in Perfect Balance… Electronic Gold will be “Stable”… Contracts will be converted to Electronic Gold… The Redemption Period should make for a smooth transition into Sound Money…

I've never seen the 1928 Hawaiian Half Dollar in all the coins shows and clubs in my region. Then again, there are many US coins I haven't seen either. I've only got an old coin catalog that lists their pictures, though the prices are well out of date.

This is a Commerative Half Doller… It’s rare in this condition…