SPS Market Analysis July 25 – July 31 2025 | Splinterlands #461

Another week, and another week where we seeing institutional momentum continuing to get involved in the crypto ecosystem. PayPal rolled out "Pay with Crypto" allowing U.S. merchants to accept payments in over 100 cryptocurrencies with just a 0.99% transaction fee. This builds on PayPal's existing PYUSD stablecoin infrastructure and positions them as a major beneficiary of recent stablecoin regulation. Perhaps even more significant is JPMorgan's strategic partnership with Coinbase, allowing customers to link their bank accounts directly to Coinbase wallets starting next year. The crypto naysayer, Jamie Dimon, has stated that he's "a believer in stablecoin, a believer in blockchain" while maintaining his personal skepticism of Bitcoin.

This week also saw the White House publish its 166-page crypto policy framework calling digital assets a "pillar for U.S. economic competitiveness" and recommending CFTC spot market authority over Bitcoin and Ethereum. A new theme is emerging with companies announcing treasury plans to buy cryptocurrencies and looking to adopt Microstrategy's approach. A Canadian vape company saw its stock surge over 800% after announcing plans to raise $500 million for Binance Coin purchases. Is this a sign of the top coming?

On the price action front, Bitcoin traded between $114k-118k, posting its first back-to-back weekly loss since early June, while Ethereum held steady around $3.6k-3.8k, posting its fourth consecutive up-week. Solana struggled more, dropping nearly 6% to around $167. With the crypto market adapting to a new institutional adoption phase, and the price action seeing a regression, how has this impacted SPS?

SPS Weekly Performance Overview

SPS endured another declining week, closing at $0.006993 and down approximately 4.7% from the previous week's close of $0.00733878. The token started the week in a consolidation pattern around $0.0073 before experiencing a notable surge on July 27th that pushed it to a weekly high of $0.00758353. This breakout looked promising initially, but momentum quickly faded. The decline was methodical rather than panicked, with SPS giving back most of its gains over the following days. The current price of $0.006993 represents not just a weekly decline, but puts SPS at concerning technical levels that haven't been tested in months. The chart pattern shows classic distribution behavior with a quick spike higher followed by sustained selling pressure.

Market Analysis - Trends

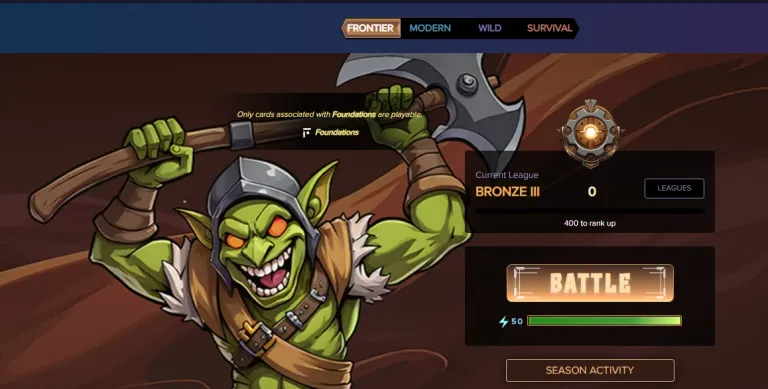

The most significant development for splinterlands this week was the launch of Frontier Format, a completely free-to-play mode that could be a game-changer for user acquisition. This new format allows players to dive into splinterlands battles with zero initial investment. Players can complete three daily quests by winning five matches to earn Foundation cards or packs, with these cards being fully transferable, sellable, and combinable. Maybe Frontier Format can serve as a funnel for converting new players into paying customers. We know that splinterlands needs as many new players as it can get!

Market Analysis - Volumes & Liquidity

Trading volumes for SPS averaged around $144k daily this week, with notable spikes to $174k on July 29th and $173k on July 25th. The volume pattern tells that we saw increased activity during both the rally and the decline, suggesting traders' participation rather than low-liquidity manipulation.

Market Analysis - Support & Resistance

The technical picture for SPS has deteriorated significantly this week. The current price of $0.006993 has broken below what was considered solid support at $0.007-$0.0072, and we're now testing levels that haven't been relevant since early 2025. The next meaningful support sits around $0.0065-0.0068, which aligns with previous consolidation zones from earlier this year. If the $0.0065 level fails, we could see a more serious decline toward $0.006 or even $0.0055, which would represent multi-month lows.

The chart structure now clearly shows that a descending triangle pattern has played out to the downside, with the breakdown confirmed. Any recovery attempts will need to reclaim $0.0072 to suggest this isn't just a dead cat bounce.

Concluding Thoughts

This week highlighted both the challenges and opportunities facing SPS in the current market environment. While the crypto market continues to enter in a new phase of institutional adoption, SPS continues its own independent path, unfortunately in the wrong direction. The launch of Frontier Format represents an opportunity to drive long-term user growth. The technical breakdown below $0.007 puts SPS in a difficult position heading into next week.

Are you new to splinterlands and want to learn to play the game? Check out my Ultimate Guide to Splinterlands: A Collection of Articles and Guides. If you enjoy reading my splinterlands content, please follow and support me by signing up to play splinterlands through my affiliate link: https://splinterlands.com?ref=mercurial9.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO

Thanks for sharing! - @cieliss