DeFi Yields Hit Rock Bottom | DeFi Journey #9

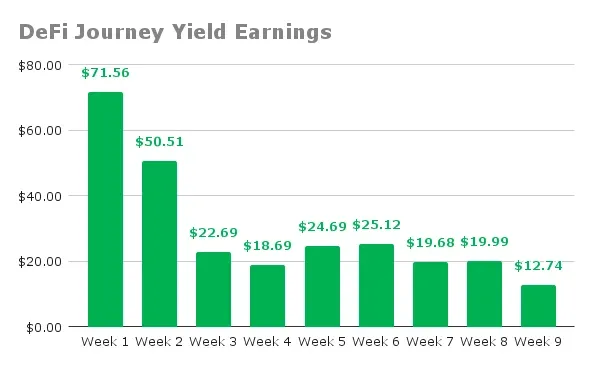

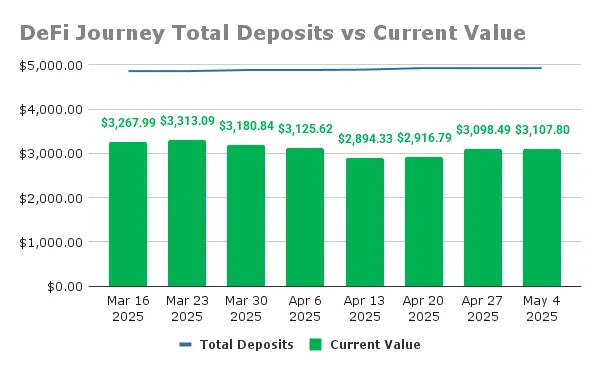

I dove into the latest happenings in the crypto markets in my latest SPS technical analysis blog, where we saw the past week that BTC steamrolled its way to $97k and ETH broke past $1.8k. Despite the price action, my DeFi yields decreased to $12.74, the lowest since I started this journey, averaging under $2 a day. My portfolio value climbed to $3107.80, up from $3098.49, but I'm still down overall. Let's break down this week's performance.

CLP - ETH/USDT - PancakeSwap, Binance Smart Chain

I harvested $4.93 this week, bringing total rewards to $191.32. The deposit remains $2,213.00, and the current value rose to $1242.27 with ETH's uptick, yielding a 33.98% yearly APR. The price difference, including fees, improved to -$779.41 (-35.22%).

- In-Range: ✅

- Range Setup: $1204.29 - $2546.84 (75% wide)

- Rewards Farmed This Week: $4.93

- Total Rewards: $191.32

- Total Deposits: $2213.00

- Current Value: $1242.27

- Yearly APR: 33.98%

- Price Difference (Inc. Fees): -$779.41 (-35.22%)

CLP - WETH/USDC - Aerodrome Finance, Base

I harvested $3.35 this week, bringing total rewards to $181.02. The deposit remains $1663.40, and the current value rose to $929.15 with ETH's uptick, yielding a 42.69% yearly APR. The price difference, including fees, improved to -$553.23 (-33.26%).

- In-Range: ✅

- Range Setup: $1202.37 - $2545.32 (75% wide)

- Rewards Farmed This Week: $3.35

- Total Rewards: $181.02

- Total Deposits: $1663.40

- Current Value: $929.15

- Yearly APR: 42.69%

- Price Difference (Inc. Fees): -$553.23 (-33.26%)

CLP - USDC/cbBTC - Aerodrome Finance, Base

I harvested $0.69 this week, bringing total rewards to $7.79. The deposit remains $156.11, and the current value rose to $161.54 with BTC's price increase, yielding a 27.52% yearly APR. This is the only CLP position that is in the green - $13.22 (+8.47%).

- In-Range: ✅

- Range Setup: $70604 - $100190 (35% wide)

- Rewards Farmed This Week: $0.69

- Total Rewards: $7.79

- Total Deposits: $156.11

- Current Value: $161.54

- Yearly APR: 27.52%

- Price Difference (Inc. Fees): $13.22 (+8.47%)

CLP - SOL/USDC - Orca, Solana

I harvested $3.77 this week, bringing total rewards to $96.47. The deposit remains $896.20, and the current value rose to $774.84 with SOL's price increase, yielding a 53.68% yearly APR. The SOL CLP position is getting closer and closer to breaking even, and this past week saw the price difference improve to -$24.89 (-2.78%).

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $3.77

- Total Rewards: $96.47

- Total Deposits: $896.20

- Current Value: $778.84

- Yearly APR: 53.68%

- Price Difference (Inc. Fees): -$24.89 (-2.78%)

Concluding Thoughts

Over the past two weeks, I haven't increased my total deposits and am keeping the yields harvested in my wallet, waiting to see how ETH and BTC price action play out before reinvesting the yields. The wider ranges didn't pay off this week, with yields dropping to $12.74, which is the worst yields since starting. The upside? No rebalancing needed for almost a month, even with BTC nearing $97k and ETH crossing $1.8k. ETH's lacklustre performance is a headache. It's my biggest position, and it shows in the returns lagging behind SOL and BTC CLP positions. I'm holding off doing any rebalancing to tighten the CLP ranges, but I am watching ETH's price action closely. SOL continues to be a standout in the portfolio even though yields dipped this week.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO