Day of 2025-08-02

Cycling the trails backwards was an experience that pushed me to see familiar routes in a completely new way. The same bends and hills felt different, offering fresh perspectives on the path I thought I knew so well.

Riding in reverse challenged my focus and balance, requiring me to adapt my rhythm.

When I checked the $XV market, I quickly saw that the project had little life left in it. Despite this, I noticed an open position for 3.5 $HIVE, which sparked my interest. The potential gain ranged between 1.75x to 3.44x, which made it worth holding onto.

From the 504 $HIVE in revenue, I decided to reinvest strategically. I picked up 75 $SURGE at a price of 4 $HIVE, believing it was a strong position for growth. To hedge my moves, I set additional positions slightly below the 4 $HIVE mark.

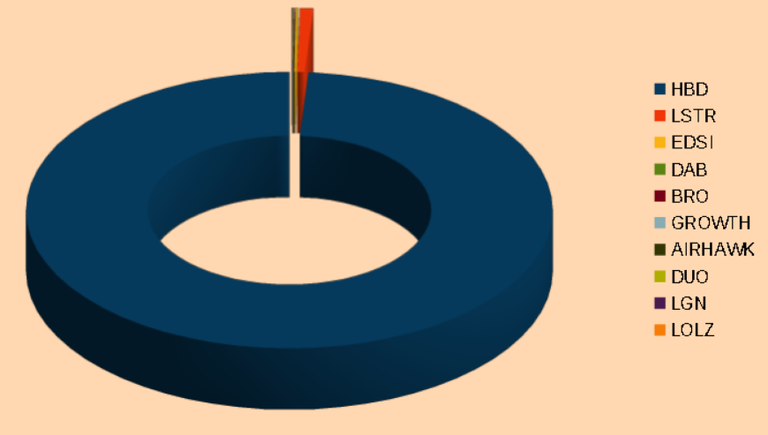

The remaining balance I allocated into $LSTR, diversifying my holdings for steadier returns.

Trading $LSTR has turned out to be one of the more consistent plays in my portfolio. On average, each trade brought in an 18% gain, which steadily boosted my returns. These gains not only increased my confidence but also strengthened my overall position in the market.

My vote weight has now risen to 11.06%, giving me more influence and visibility in the ecosystem.

It shows how small, consistent wins can add up to bigger advantages over time.

The $HIVE market has been bouncing back, though not in a strong upward trend yet. I found myself locked in around the $0.20 mark, which tested my patience.

Despite the lack of big movement, I remain optimistic about a rebound. Markets often take time to recover, and resilience is part of the journey. I believe we will return stronger, and holding steady now will make the eventual rise that much more rewarding.

!ALIVE