LBI Weekly Holdings and Income report - Week 59 - week ending 14 September 2025

Another week in the books for the LBI project, and here are our weekly positions and updates, recorded for transparency on the blockchain. For those that don't know what LBI is, basically we are a small investment fund on Hive's layer 2 that has investments in a number of selected projects, and a focus on the LEO token economy as our biggest position. These reports are the best way to get a feel for what we are about.

Each week we start our reports with a look at the current token prices of our holdings, at the cut-off time for the report, and drop a link to our last report so people can do their own comparisons.

And then we take a deep dive into each of our wallets.

So here goes:

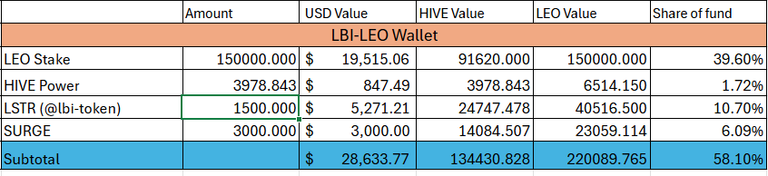

@lbi-leo wallet

Over the last week, we have re-allocated some more of our LEO into other positions. In this wallet we have boosted our HP position a bit to increase our income from @leo.voter delegation. We also added some more SURGE to take us to 3000 total for that. Our LSTR is counted in this wallet, as it is a LEO economy investment, but it is held for now in our main wallet @lbi-token as it is our main posting account. This division gained a couple thousand dollars in value over the week, despite some funds being moved out of it. Sitting at 58% of our total fund currently.

In the short run, our LEO sales have finished for now, and we hold 150,000 at present, all delegated to @lstr.voter for passive income.

@lbi-token wallet

Steady week for this wallet, with the only change being the addition of a bit more HBD, to bring us up to 2500 HBD in savings this week. This will generate us a reliable 1 HBD per day in interest that we can use for our dividends and pool rewards.

No other changes of note this week. We are earning LGN from a delegation to @legionsupport. The remainder of our delegations are to @empo.voter which earns us PWR each day to help grow the @lbi-pwr wallet you will see below.

Lastly, our BEE is delegated to @bee.voter and earns us a nice weekly HIVE income.

@lbi-pwr wallet

I have added a decent amount of HIVE power to this wallet this week, pushing it over 6000 now. Ideally, I'd like to have this at 20-25K to be honest, but to do that I'd have to sell a lot more LEO and I think that's not the best idea currently.

Our liquidity pool position grows through compounding each day, and we spin out a small income from the wallet from daily HIVE earned from the staked PWR, plus some HIVE earned from the LP.

@lbi-eds wallet

Over the week I have added around 1000 HP into this wallet, and 130 EDSD. These both benefit us by minting more EDSI tokens each week. The HP is delegated to @eds-vote to earn weekly EDSI distribution, and the EDSD is backed by HBD and also mints weekly EDSI for holders like us. They also benefit the long term stability and sustainability of the overall EDSI project, and helps accelerate the path to EDSI moving to permanent APR increase. Over the week, we grew our EDSI stack by 36.83 tokens.

@lbi-dab wallet

This wallet didn't receive any extra funds this week from our LEO sales. Organic growth has been decent, with 40 DBOND growth for the week, and almost 40 DAB also. Both those tokens are on our books at a value of 1 HIVE each, so that is 80 HIVE asset growth per week - nice.

Totals

So when we add together all our wallet, we get our total fund value.

In dollar terms, the fund has gained $4,421 in value over the week. Our biggest assets being LEO, HIVE and LSTR are all up a bit in value over the week, which has pushed the fund value nicely up by very nearly 10%. Winning.

The HIVE, LEO and BRO valuations all are around the same as last week, and the LSTR comparison is down a bit as LSTR has performed very nicely this week.

Overall, a very nice week for our fund, and we are very close to the $50K mark. Given that for a big portion of the last year, the fund was hovering around $20K, we are now in a very good position and our token has been a good hold for those here for the long run.

Income & Distribution

In this section we break down our sources of income, and how we split it up. We made a little over 200 LEO in income for the week, which is a bit less than last week. As LEO increases in price, our HIVE and HBD income can buy less LEO tokens. Given that most of our investments are in place to grow assets, and income is the final outcome, this is decent.

The quickest way to boost our income in the short term would be to sell some LSTR and use the money to buy more SURGE. I'm tossing up on this move, let me know what you think please in the comments.

As you can see we have sent out 83.427 LEO as dividends to LBI token holders. The yield is very small, but LBI is set up as a growth fund with a little (but hopefully growing) dividend attached.

We burned 2.835 LBI tokens this week. Each week a small portion of income is set aside to buy back and burn some of our tokens, reducing the circulating supply each week. With a slowly decreasing number of LBI tokens in circulation, and a slowly growing asset base, the value per token should trend higher over the long run.

Liquidity report.

Adding a new section in to this weeks update post. LBI currently has four liquidity pools available for our token, paired with assets selected for specific reasons. There is also the traditional Hive Engine order book.

LEO/LBI - our longest running, and deepest pool. Pool rewards have just been renewed for 120 days, and it is distributing 22 LEO per day to liquidity providers. 20% APR for providing liquidity.

LSTR/LBI - This pool provides trading options and arbitrage routes. 3 pool combo's do well for arbitragers, generating fees for added yield for liquidity providers. This pool gives a LBI, LEO, LSTR triangle for those traders.

LBI/BRO - An interesting experiment to combine two very different investment fund tokens into a pool. This also opens up triangle arbitrages with LBI, BRO, HIVE options.

LBI/HIVE - Our newest pool, also adds triangles between LBI/LEO/HIVE and LBI/BRO/HIVE for extra volume. The other reason for it's existence is that some LBI holders are not keen on the extra LEO exposure in the primary LBI/LEO pool, but would be more likely to join a pool with HIVE.

Volume

These are the volume totals for the pools over the last 7 days. As you can see, all 4 pools do generate fee's for liquidity providers, which add to their positions. Not a lot, but that is on top of the LEO yield. In addition, the LBI held in the pools also is included in the weekly dividend run. It' looks like the new HIVE pool hasn't been added in to that calculation yet. I'll hassle our coder that runs the div bot to get that fixed before next weeks dividend run.

If you are interested in adding liquidity, just keep in mind the risks associated with providing liquidity and make your own decisions around that.

Conclusion.

A good week overall for LBI. Values are up a bit, and we have built up strong positions in a number of different HIVE based investments.

I hope you found value in the new liquidity section useful, let me know what you thought. I wish H.E. pools had some better tracking and analysis info available, but there isn't much accessible info.

Thanks for checking out this weeks update,

Have a great week everyone,

JK.

@jk6276 for LBI.

Posted Using INLEO

It's been ages since I've checked the LBI report. Thanks for the work you're putting in. I see no one commented on the post, what a shame!

Hey thanks for checking in. Comments are not so common for us, but I do still think LBI holders do check the report each week regardless. I like to take a quiet comment section as meaning people are happy with how it's going.

Also I moved the report to an earlier time, during the weekend which may be hurting its visibility???

Anyway, Thanks for stopping by and holding some LBI.

I don't think so. Whoever is interested, can check it on any day. I suppose many don't understand it and are interested only on how much it worth I think.

i check but rarely comment.

I thought that you're checking it :)

@silverstackeruk is always watching.

I can imagine the pressure on you 😂

Sir, can I give you a suggestion? You have 100k hives which are in savings. If you want, you can power it up and earn hives continuously by voting. If I have said anything wrong, please forgive me. Thanks.

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 91000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPHello lbi-token!

It's nice to let you know that your article will take 5th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You receive 🎖 0.3 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 786 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART