LBI Weekly Holdings and Income report - Week 51 - week ending 20 July 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

What a week it has been - things are really heating up for LEO, and the price is on the move big time. Will it keep climbing - I think so with the changes to tokenomics already showing the path forward for LEO.

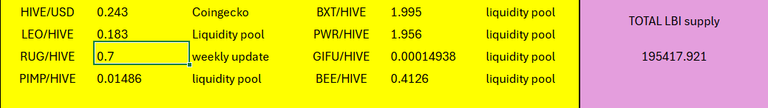

Here are the asset prices used at the time of this report:

And here is last weeks report for comparison:

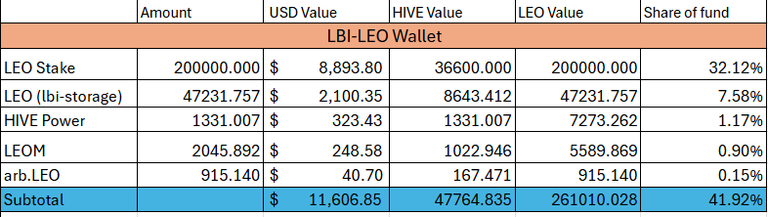

@lbi-leo

The LEO wallet surges into top spot as our most valuable wallet this week.

We have gained around $4350 in value over the last week. The LEO price has moved up from 0.1119 HIVE to 0.183 over the week, which is huge for us. Don't tell the LEO maxi's, but I did sell a small amount of LEO this week (around 3000) to move some funds into other wallets. 🤫 Couldn't resist the urge to take a little profits.

One thing I want to point out. The LEO we have liquid in the storage wallet (@lbi-storage) came from a payout from the old bHBD unwrap situation. For ages we carried that on our books at an estimated $1500. The current value of the LEO we received as compensation (given I have sold a small portion of it) is $2100. So we are sitting on a nice profit on this compensation payout. 🤑

Last week I mentioned a possible vote for LBI holders around an OTC deal for LSTR. We have not proceeded with that deal, so there won't be a vote. I wish nothing but the best for @leostrategy, but it would have been a divisive issue for LBI holders and I didn't want the drama to be honest.

Overall, an awesome week for LEO and for our holdings. Let's see what next week has in store for LEO.

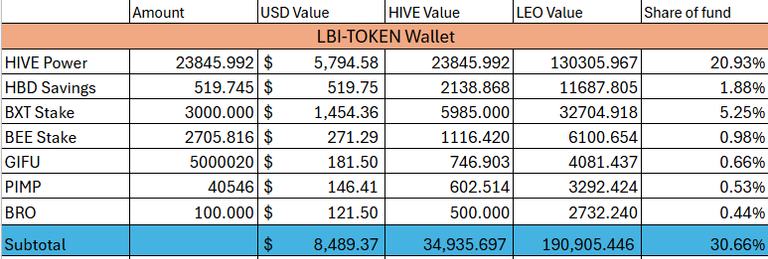

@lbi-token

The Token wallet drops to second place in our list of wallets ranked by total value. The value of the wallet is up slightly, but the surge in LEO means the LEO wallet dwarfs any rises here. We had a nice week with two big post payouts meaning we added 108 HP over the week. The other change is that I bought some extra BEE from the small LEO sale I mentioned above.

I took a closer look at this wallet earlier in the week, and so you can check that post out for more detail.

https://inleo.io/@lbi-token/taking-a-look-at-our-wallets-part-2-token-k31

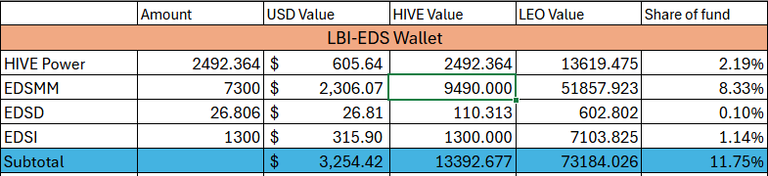

@lbi-eds

The EDS wallet is down slightly in value this week, because I reduced the carrying value of the EDMM tokens again. Whenever the overall fund has a good week, I decrease the valuation on these slightly, as I want to adjust them eventually to a one HIVE each value. They are tokens with very low liquidity, and would be hard to sell on the open market. I think around 1.4-1.5 is a fair value, given that they mint EDS at an expected rate of 0.2 EDS per miner per year. But could we sell them for that price if we wanted to?

Anyway, they will happily mint us over 20,000 EDS over the next 15 years, so there is nothing to complain about. We added 25 EDSI this week, and a couple of EDSD to the wallet.

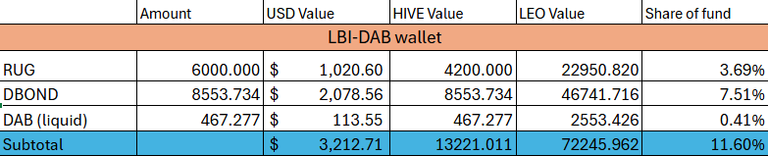

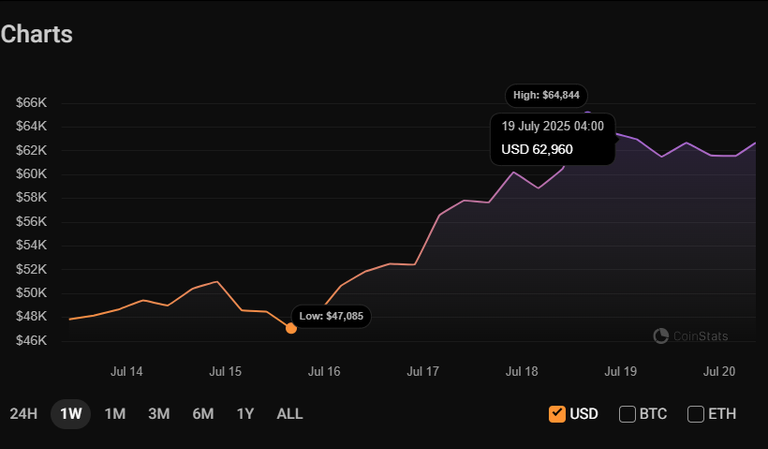

@lbi-dab

The DAB wallet comes close to overtaking the EDS wallet this week. I did buy another chunk of DBOND this week, at 0.8 HIVE each. DBONDS are backed by one HIVE each, and that is their carrying value in our reports. Anytime they are available under one each is a good buy. So we bought 290ish and received 20 from our RUG investment. I checked with SSUK and our RUG is still fairly valued at 0.7 so that is nice.

We are minting DAB quickly at the moment, gaining 30 this week. The nice part is that each day the DAB drip is a little bit higher, so we are minting DAB faster than the APR drops on them meaning our income grows (in HIVE terms) consistently. Once we convert that income to LEO however we get a different picture.

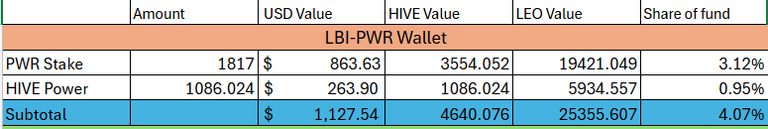

@lbi-pwr

Simplified this wallet during the week, by closing our small pool position. The LP is great, but we only had a little and the choice was to build it up or close it down. We have plenty of HIVE exposure in other parts of the fund, and maximizing our PWR position was the goal. So the wallet now is simply PWR staked and HP. Everything that came out of the pool got staked as PWR, and I bought some extra from the LEO sale also.

The PWR project itself is performing very well, with the assets it holds rising nicely in value over the last week. Their project holdings moved from $48,000 to over $62,000 over the last week, thanks mainly to the ETH price move. If you are interested in #PWR and want to watch it's investments, you can do so (here)[https://coinstats.app/p/BONHgVX1Ehp7Eux/).

As I say every week, this is a project I'd love to have a much bigger position in.

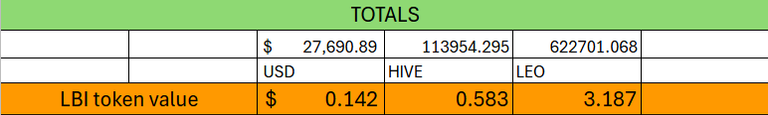

Totals

Up by $4700 in value over the week. The HIVE value is also well up, with each LBI token now worth close to 0.6 HIVE. As expected when LEO goes up so much, the LEO value of the fund drops. This is because all the "non-LEO" assets are worth less LEO in value. At the end of the day, the USD value is the one I personally watch, and we have gone from $0.118 to $0.142 in the last week.

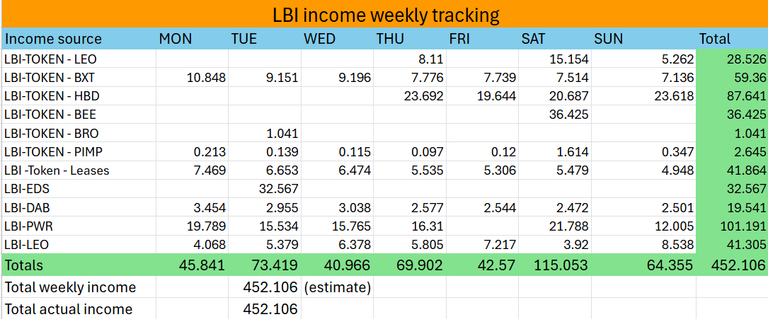

Income

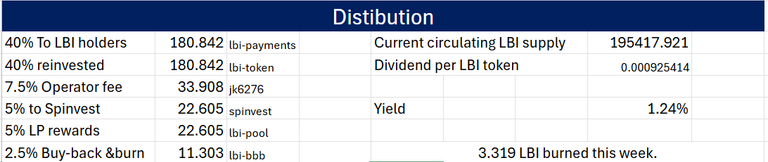

Income is well down again this week. I say it every week lately, but when LEO goes up, the HIVE we earn from most of our wallets buys less and less LEO in token terms. Overall, not much to report, I have been able to use some HBD to boost this a bit thanks to a couple of nice post payouts, but all sources of income are generating less LEO tokens.

180.842 LEO sent out as dividends this week - worth $8.04 total. Last weeks dividends were valued at $6 each, so even though there is less LEO going out this week for dividends, it is worth more than last week if that makes sense?

3.319 LBI burned this week.

Conclusion.

A great week overall. We gained nicely in value over the week, and the story of the week is obviously LEO. PWR also had a good week, but LEO is the star of the show for us at the moment. Will not be surprised at the rate it's going if LEO isn't at 0.25 HIVE each this time next week. Time will tell, but it sure is on a role at the moment.

Thanks heaps for checking out this weeks update post, feel free to drop a comment to let me know you visited and saw what we have been up to lately.

Cheers,

JK.

Posted Using INLEO

Nice report! Good to see the focus on income sharing with token holders. 🐎💰

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 83000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP