Interest Rate Battles | Trump vs FED

With the decrease in inflation all over the world, interest rates have started to fall. Countries that continue to maintain high interest rates either want to continue to accumulate reserve money in their central banks or. They act more cautiously and stop the markets from cooling down. In the US Central Bank, this situation is an attempt to stay on the safe side against a possible inflation attack by approaching more cautiously.

This safe haven effort is of course causing the economy to slow down seriously, corporate earnings to fall and people to be unhappy. As every politician knows very well, high interest rates bring unhappiness. While Trump wants the central bank policy interest rates to fall, he actually wants his path to be easier and for people to be willing to buy corporate stocks at higher levels and for the markets to enter a bull season with everyone buying higher. When he took office, NASDAQ and S&P500, which were already at very high levels, should have lost value and reached reasonable levels so that he could encourage people to put money into a market that they believe is less of a bubble.

This is what is starting implicitly right now. The war between the central bank and Trump is unfortunately being played out in front of everyone's eyes. Jerome Powell's current term is set to conclude on May 15, 2026.

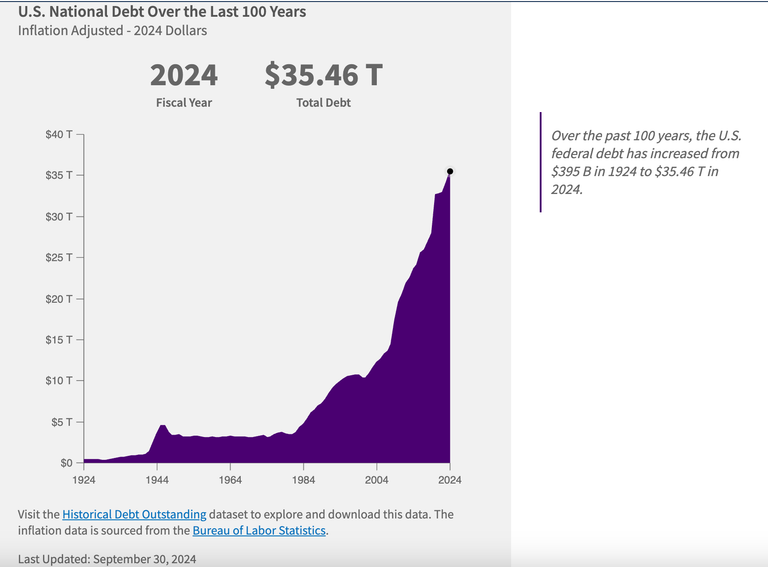

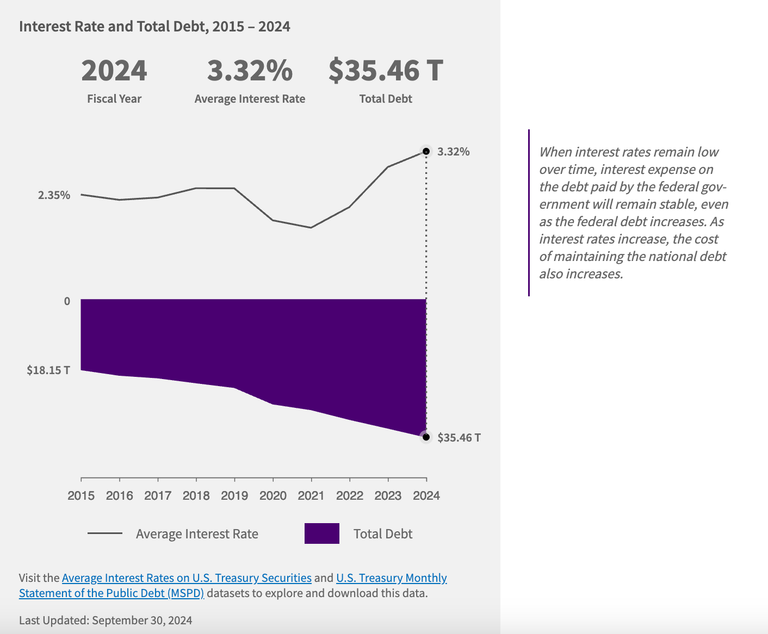

The U.S. national debt has been going up and the pressure on Trump's shoulders makes him more aggressive, considering his statements.

The secret of growth is finding cheap debt and making more money from it. If the governments cannot find a way to get loans at low interest rates, they always face economic and social issues as a consequence of the budget tightening.

The average interest rate was around 3.5% in rhe U.S., whereas it hovers around 4.5% now. The market does not expect to see a cut until June, which may be the first of 2 or 3 cuts in 2025. The interest rate battle between Trump and Powell is likely to continue for some time. However, when the risk of recession hits hard, Powell will be the one who cuts the rates like there is no tomorrow.

It's all about time for Trump, knowing that the global conditions are not ready to put their money in U.S. markets and risky alternatives like cryptocurrencies.

What do you think about the clash between Trump and Powell?

Share your thoughts below 👇

Hive On ✌️

Posted Using INLEO

https://www.reddit.com/r/Economics/comments/1ka5ldw/interest_rate_battles_trump_vs_fed/

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Great topic! From what I have read, Trump's political goal is to push the FED to issue lower rates to promote economic growth and strong stock markets. But I wonder, isn't the US stock market already too strong? It has grown a lot in the last 4 years. So I note that TRUMP is struggling a lot to achieve his goal. Another thing. The US pays interest on debt that is too high. I still believe that the FED would do well to lower interest rates all things considered !PGM

The pressure is at both ends. Not going to be an easy one to get those cheap debts as Trump suggested. Every country is becoming very cautious on global dealings.

As for Powell, Maybe just as you've said, when it gets to his throat it may result in a double slash.

Congratulations @idiosyncratic1! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: