The Buffett Indicator Warning: US Stocks Have Never Been So Overvalued...

I came across a rather useful tool today - the "Buffett Indicator" - but before I dive into that, bear with me as I backtrack a bit...

Is Bitcoin's 4 Year Cycle Still a Thing?

A couple of months ago the guys who run the @liotes project asked us to predict where we thought HIVE would be in a year's time (May 2026) on a scale of 0-100 with 50 being "the same valuation as now." I gave it a score of 68 and explained why in the comments. Check out the original post here:

https://hive.blog/tribes/@liotes/hive-barometer

In other words, two months ago, I was predicting a moderate appreciation in the value of Hive against the US dollar. However, I was struck by a bearish comment by @mypathtofire who wrote:

I give Hive 40. It has some staying power, but we don't know what the bear market will be like next year.

I asked @mypathtofire to clarify his comment and he pointed out that we are currently in the third year of the "four year cycle" of Bitcoin and that the fourth year is typically a bearish year for Bitcoin, which causes alt coins to decline in value too.

Of course, the debate right now is around whether or not Bitcoin has broken out of the four year cycle and my guess was that it probably had, or at least, my expectation was that Bitcoin would continue to rack up new all time highs deep into 2026, accompanied by bouts of volatility...

However, @mypathtofire his comments gave me pause for thought, in spite of my long-term bullish outlook for Bitcoin...

Then, today, I came across the "Buffett Indicator" while watching a Youtube video during a ten-minute workout - and it also gave me pause for thought...

What Is The Buffett Indicator?

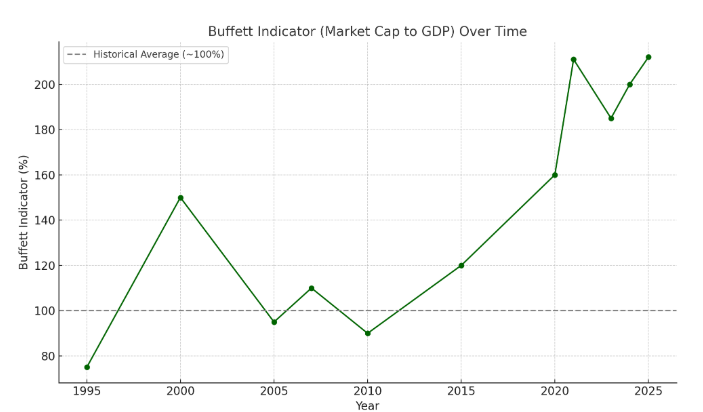

The Buffett Indicator is a way to measure whether the stock market is overvalued or undervalued. According to Wikipedia it was,

"proposed as a metric by investor Warren Buffett in 2001, who called it "probably the best single measure of where valuations stand at any given moment"

It compares the total value of all publicly traded companies (market capitalization) to a country’s total economic output (GDP). If the stock market’s value is much higher than the GDP, it may suggest that stocks are overpriced and a correction could happen. If it's lower, it might mean stocks are undervalued.

In other words, if the indicator is above 100%, the market could be overvalued; if it's below 100%, the market may be undervalued.

Of course, it’s not a perfect tool because it doesn’t look at interest rates, global markets, company profits, political factors or "black swan" events, but since valuation is a key metric, it is well worth keeping an eye on.

What is the Current Situation?

Right now the Buffett Indicator is signalling a record level of market overvaluation, back up and pushing beyond the overvaluation of the 2021 Covid stimulus bubble, and well above the levels of the 2008 crash.

The best analysis that I have found, which includes a section outlining criticisms of the indicator model is here:

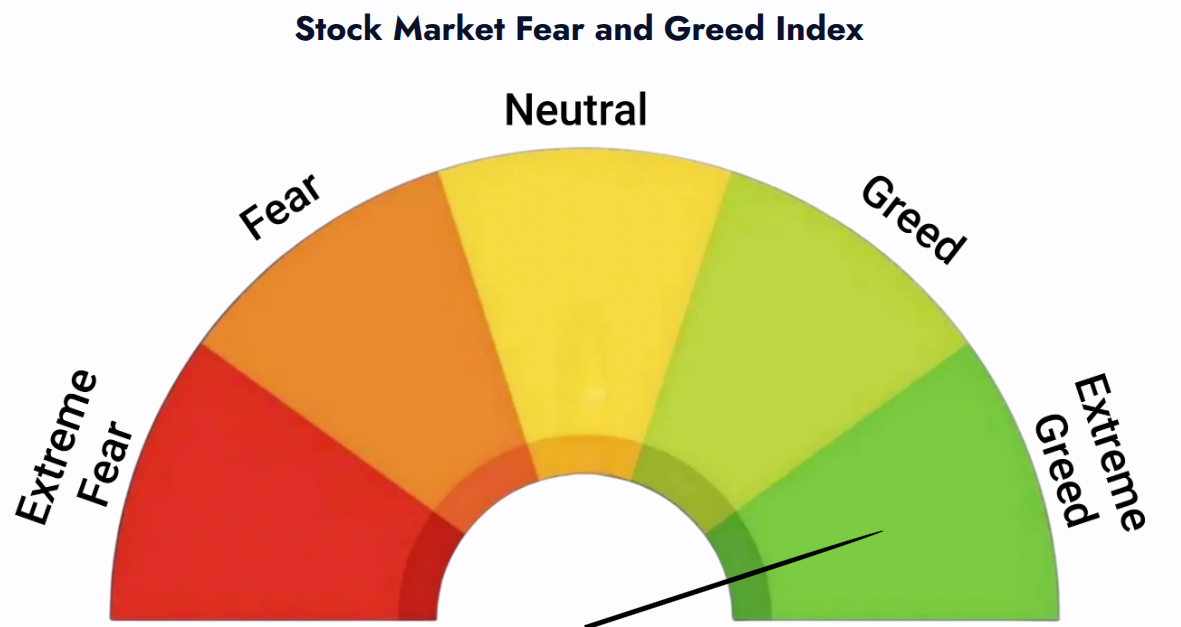

The Fear/Greed Index

You'll probably be familiar with one of the most famous dictums of the Sage of Omaha:

Be fearful when others are greedy. Be greedy when others are fearful.

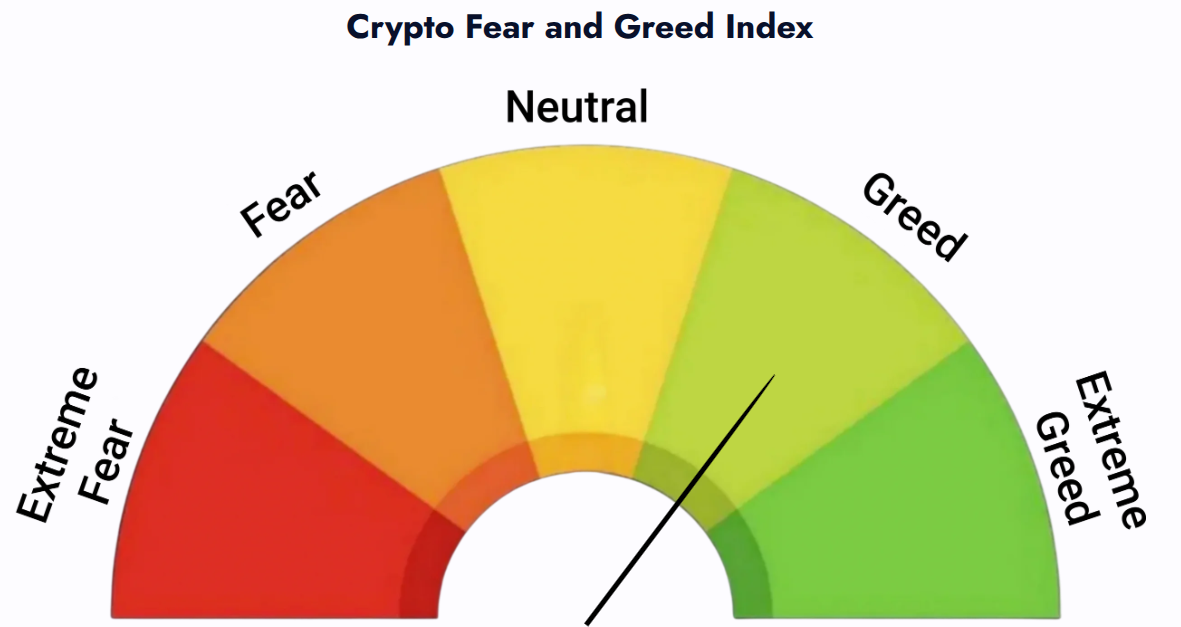

To help us achieve that, there is another metric indicator on the BuffettIndicator website, the "Fear and Greed Index." It measures the "fear/greed" sentiment in relation to the US stock market, and the "fear/greed" sentiment in relation to "Bitcoin and major altcoins" - so not HIVE then!

Here's the state of play with US stocks right now:

And here's how things stand with the crypto markets right now:

Ho ho, we are only in the "greed" stage for crypto! Maybe there's some more upside to be enjoyed...!

Source: https://feargreedindex.net/#crypto-fgi

What Does This Mean for Hive?

The short answer is, "I don't know." However, I will offer here the reasoning behind my moderately bullish prediction for the price of HIVE in May 2026, which was:

If you look at this Hive chart https://www.coingecko.com/en/coins/hive and set it to max you see that Hive hasn't dropped into single figures - the lowest I could find was back in April 2020 when it briefly dropped to about $0.103. Today [May 2025] it's around $0.255 and the lowest it's dropped in the last year is about $0.16. I think there is more upside than downside potential, and if Bitcoin goes on a charge Hive could well rise on the updraught.

The final "if" is still possible. Perhaps Bitcoin has broken the four year cycle, and even if it hasn't, HIVE might not suffer as much as some more speculative alt coins if the bear market kicks in next year - "might not" being the key phrase, because for all I know, it might!

However, what I can say is that the Buffett Indicators suggest that we should be a little more fearful than we might want to be at this stage...

I'm not suggesting that you go and sell your Bitcoin while it's over $115,000 because I'd prefer to hold for the l-o-n-g t-e-r-m come what may. Come what may in 2026, I am definitely long-term bullish!

More specifically, in the short term, since I have recently borrowed against my Bitcoin to chuck $1,000 into HBD, I think the prudent thing for me would be to make sure that I reduce my exposure to some degree. I think that it would be better NOT to borrow against Bitcoin when Bitcoin is racking up new all time highs, and indeed, I borrowed when Bitcoin was at $107,000 so I have built up quite a nice cushion with the recent surge in valuation, with only 50% of my BTC collateral tied up in the loan, and some of the loan paid off already.

https://hive.blog/hive-125568/@hirohurl/using-bitcoin-to-borrow-usdt

I am happy with this strategy of using Bitcoin to build up my HBD position without selling Bitcoin, but I am not going to get too greedy and increase my risk exposure just to squeeze more cash out of my Bitcoin right now, when so many others are getting greedy and talking as if the only direction for their favourite crypto (e.g. Hive's 2nd tier $LEO token right now...) is UP! LOL!

Conclusion

I think the Buffett Indicators are well worth checking from time to time, especially if you are getting excited by all the froth. Just because "there's only a limited number of Bitcoin" doesn't mean that a bunch of the holders of the said "limited number" can't suddenly panic and dump them on the market!

Yes, I'm a long term bull... and a HIVE token stacker, but I'm not going to max out my credit cards to buy more Bitcoin - especially when the Buffett Indicators suggest the stock market is significantly oversold, and that the sentiment is either "greedy" or "extremely greedy"!

What do you think? Are you bullish or bearish and why? Let me know in the comments!

Cheers!

David Hurley

#InspiredFocus

Wow lot's to take in and process, for me i am here for the community and building the tribe i believe the value will grow as the communities do regardless of what goes on.

The digital currency market is still new, like most markets volatile and open to manipulation.

Wishing you success on your journey

@hirohurl

!ALIVE

!BBH

I will be including this content on the @heartbeatonhive curation collection

Project Moderator - @benthomaswwd

Made in Canva

Thank you @benthomaswwd - I think volatility can be our friend, as long as we stay on the right side of it!

!ALIVE

!BBH

Thank you for that good share. !LOLZ

There is way too much greed in the world. And Buffet is not shy about greed. He admits it in the quote you provided.

If your greedy your part of a #TooFuckeh problem that needs solving.

About the US Stock Market. It is no longer representative of value as it was when Buffet became the Mutual of Omaha. A small percentage of the population is driving prices up for everything. Why? Because of greed. Prices of most shit doesn't need to go up to sustain a healthy lifestyle for everyone on Earth.

Never exclude corruption in any investment analysis. Especially so with Bitcoin.

Again, we have a very small percentage of holders that can easily offset the impact of all other holders. The price could easily drop just based on Trump behaviour. It is an unpredictable asset. Technical analysis helps in the decision process but not so if you don't trust or understand charts.

About the US$ I say it is way over priced, has been, everything has a cycle and it could very well be in a long devaluation for years.

I do like speculating so I would not be surprised if Trump is planning a huge rug pull on the dollar, initially and then drive it back up as part of raping and pillaging all other economies.

I could say more but I gotta go...

Thank you for responding to my post @fjworld - I appreciate it.

I don't know what the solution to human greed is, but since it exists, I think we should take it into account when making decisions, especially financial ones.

I suppose corruption is an offshoot of greed, as is market manipulation. I think the Buffett Indicator can still be useful in showing us where the market stands in relation to GDP - if the market is being manipulated upwards, then we should indeed be "fearful" and if it's being manipulated in the other direction, we can also act appropriately and be a bit "greedy" - or, if you prefer, a bit "prudent".

!ALIVE

!BBH

Influence people to change so they are more caring of others need is a start.

It is. Just not like it use to be because the world is changing rapidly.

Greed, an emotional desire to need more than you need.

Corruption is doing things that destroys trust.

Manipulation is applying techniques that gives you an advantage.

They are similar in that they are negative energy producers.

About Hive. I am pleased with the current trading range.

I don't need it to run up to make a bunch of money. I prefer stability so that we can focus on building productive systems for the community as a whole. The peaks we see in the trend are trading manipulation. I have only been on Hive since March 2023 and experienced enough to understand that I need to implement measures in my project to offset external trading manipulation. Not always a concern but can be a huge factor with little warning. In my project, I created ePay token which I link to US and Canadian dollars and some Real World Asset.

I am all for being prudent. The thought of greed is erased by implementing a prudent risk management plan. !LOLZ

Thanks again for the exchange. I am process centric and not so fixated on targets and destination. I'm in for the journey and collaborating on shared journeys.

I follow the #PEPT philosophy to #LearnBeforeYouEarn anything. It helps me to slowdown and not get too excited about hills and valleys.

May Positive pepEntropy be with you.

That was an interesting read for me-easy to understand mostly!

Being a layman here, I am just hanging here :)

!ALIVE

Hey @hafiz34 - thanks for popping by. I wrote this post as one layman talking to another while hanging out on the Hive blockchain!

!ALIVE

!BBH

While I do think that various metrics like this are indeed useful, honestly I'd say that we're in uncharted waters now, both in the world, and with crypto, and while there will very likely be volatile ups and downs, I'd say that blockchain-crypto-web3 frameworks are on the edge of truly mind-blowing expansion and growth, so I am extremely bullish. 😁 🙏 💚 ✨ 🤙

Hi @tydynrain - thanks for your comment. I too am bullish in the long-term, but I do begin to wonder about the next 18 months or so...

!ALIVE

!BBH

Hiya, David. Of course, you're most welcome. Yep, long term there's no question, but you're right, the next year and a half are very challenging to call. 😁 🙏 💚 ✨ 🤙

!ALIVE

!BBH

Is a foot for though, in fact to think less is understatement. In as much as we do not have the means to influence the outcome, we hang out and look forward for the best.

!ALIVE

!LOLZ

This is an interesting one.

The bearish period is really taking long.

I would have thought things were going to collapse in 2022. Everything is on fumes. Crypto will bang though because it's everyone's last hope.