Buying Family Health Insurance Apart from Health Insurance given by my Employer - Should one buy a separate health insurance plan?

Hey All,

I am a salaried employee and I have been provided an health insurance plan that covers my family. But then the question is should one buy a separate health insurance plan or not? In this post we will be exploring as to why one should also be having a separate insurance plan apart from the one provided by their employer.

Lets start with taking my example only. I do have a dedicated health insurance plan from my family and I am paying close to Rs.30K+ which is approximately $360+ as an insurance premium per annum. This is not a small amount but the benefit that it provides in long run is significant and far outweighs the initial cost, making it a wise investment. Just imagine retiring or facing unemployment during a family emergency. Without medical insurance, you'd have to pay all the medical bills out of pocket, which can cause a deep financial burden. Self owned Health Insurance helps prevent this stress by covering such unexpected expenses. Ok enough of knowledge lets now get to the point straight away. I have an insurance plan from a renowned company named HDFC Ergo and I have been getting my health insurance renewal notices every now and then and also call reminders to renew the policy. It is important to note the premium amount paid under health insurance plans qualifies for deduction under section 80D of the Income Tax Act. So one can take advantage of that as well. This my policy in a nutshell Optima Secure

So why I choose HDFC ERGO Optima Secure...

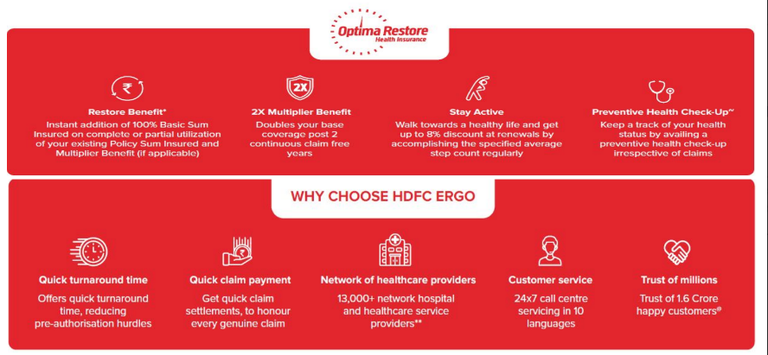

First this is not for the first time that I am going with HDF Ergo. I have many other insurance policy with them like two wheeler and home insurance [Bharat Griha Raksha Policy] as well. Plus I having the HDFC ERGO Optima Secure policy for almost 5 year now this is the 6th Year that I have renewed the policy. I got many call from different vendors to port the policy with them with a lesser premium but I just ignored them and decided to be a loyal customer of HDFC ERGO. Coming to the different benefits it provides then here are some of the main listed...

- 12,000+ Cashless - Healthcare Network

- No Cost Installment Benefit

- Save Tax Upto ₹75,000 max limit

- Provides a family floater plan

- 1.5 Crore+ Happy Customers

- Secure Benefit 2X coverage from day 1

- Plus Benefit 100% increase in coverage

- Restore Benefit 100% restore coverage

- 5% online discount

These are some benefits but I guess there would be many more and one can refer them here.. I am having that peace of mind of having a separate health insurance plan without having to worry what will happen when I retire. Also if one doesn't take the policy at an early age then at a later stage the premiums are going to be hefty along with a waiting period of 2 or 3 Years before making certain claims, especially those related to pre-existing conditions, can be made. Buying early not only ensures lower premiums but also helps you complete the waiting period sooner, offering quicker access to full benefits when needed. Well this should be it for todays post on - "Buying Family Health Insurance Apart from Health Insurance given by my Employer - Should one buy a separate health insurance plan?".. Do plan on your family health insurance... take care... cheers

Have Your Say On - Buying Family Health Insurance Apart from Health Insurance given by my Employer...

Do you have a separate health insurance plan OR rely on the insurance plan provided by your employer? If you have a insurance plan then of which company and what is the sum Insured you are opting for? Let me know your views in the comment box below. cheers...

Buying Family Health Insurance Apart from Health Insurance given by my Employer - Should one buy a separate health insurance plan?

#HealthInsurance #InsuranceCoverage #HealthSecurity #MedicalProtection #InsuranceMatters #AffordableHealthCare #hdfc #hdfcergo

Image Credits:: hdf ergo

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Stocks, Blockchain & Cryptos and have been investing in many emerging projects..

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 10.00% vote for delegating HP / holding IUC tokens.

@tipu curate

Upvoted 👌 (Mana: 12/72) Liquid rewards.