Locked, Loaded, and Dripping Dividends Let’s talk about how I’m turning small bags into income stacks passively.

Locked, Loaded, and Dripping Dividends

Let’s talk about how I’m turning small bags into income stacks passively.

I just deployed a $104.81 portfolio into an aggressive dividend paying strategy. Yeah, the numbers are small now but the compounding effect of dividend reinvestment and daily allocations is the silent killer move here. I’m building a cashflow empire brick by brick. This is not a meme stock pump. This is foundational wealth built through boring consistency and high-yield dividend plays.

Here’s how it breaks down:

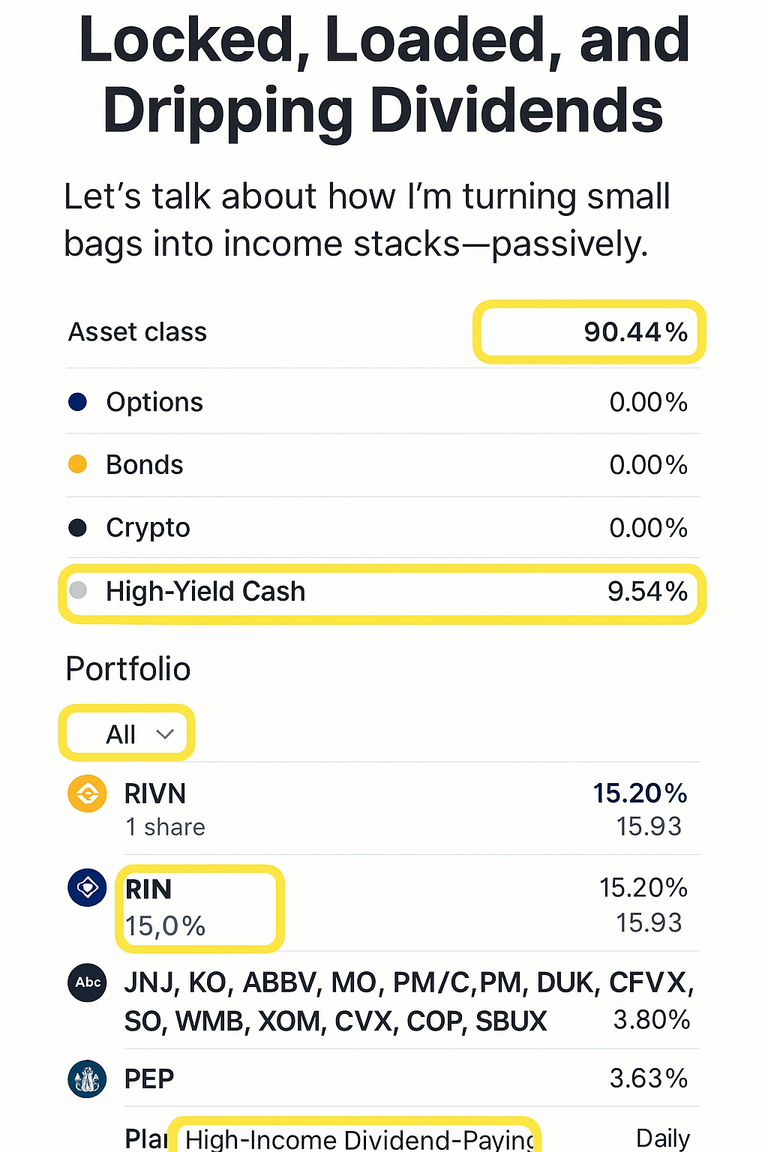

90.44% in Equities – I’m not just throwing darts here. These are elite dividend-payers, some of the most reliable brands in the world.

9.54% parked in High-Yield Cash – earning 4.10% APY while I wait for good entries or dry powder needs.

Top holding right now? RIVN 1 full share sitting at 15.20% of the portfolio. It’s the only one here not paying a dividend yet, but it’s a speculative growth hedge baked into a dividend fortress.

The rest? A who’s who of income royalty:

JNJ, KO, ABBV, MO, PM – healthcare, consumer staples, and sin stocks printing cash.

DUK, SO, WMB – utilities, that’s mailbox money.

XOM, CVX, COP – oil majors keeping the dividend pipelines open.

SBUX, PEP, TXN – global brands with consistency.

LMT, BX, MDT, VZ – defense, finance, medical, telecom, all paying and growing.

Every single one of these positions is set to drip-feed cash back into the account. This is not about 1000x plays. It’s about scalable wealth with limited downside and reliable upside.

Strategy in play:

Daily allocation of $20 into a “High-Income Dividend-Paying” plan. That’s the grind. Rain or shine, markets up or down cash hits my account daily. I don’t panic sell. I accumulate.

Why this matters:

I’m not here chasing candles or chasing clout. I’m automating wealth. This is a stress-free, low-velocity way to stay exposed to markets while keeping my income goals at the center.

The kicker?

This strategy compounds. The yield funds more purchases, which increase yield, which buys more stock. It’s a flywheel.

Inleo fam if you’re still trying to YOLO into crypto every cycle, do your thing. But if you’re serious about long-term sustainability, you might want to get on board the dividend train now. It’s not sexy, but neither is struggling when you’re 50.

Posted Using INLEO

Congratulations @databaron! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 9000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP