Bitcoin Price Reversal is Almost Here

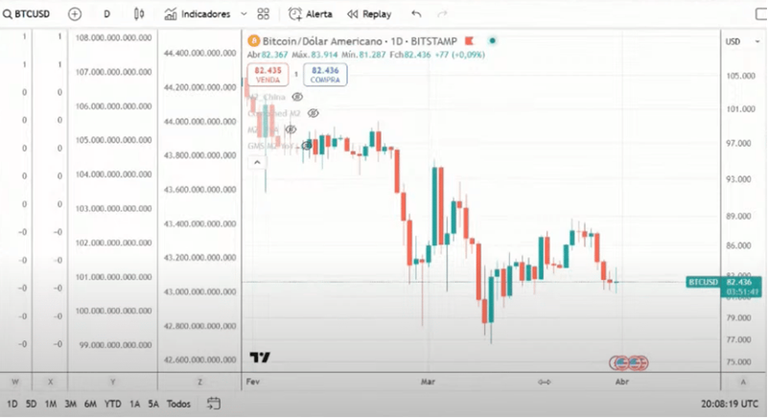

This week has been a real rollercoaster for the markets — and Bitcoin, of course, was no exception. Let's understand what's going on!

On Monday, several stock exchanges around the world fell and BTC followed suit. As if that weren't enough, today Trump promises to start applying reciprocal tariffs to ALL countries. Yes, the world stopped to listen.

To give you an idea: On Sunday night, the Japanese index was already down 4% on the daily - which is A LOT for the traditional market. The Bank of Japan raised interest rates again, and that scared a lot of people.

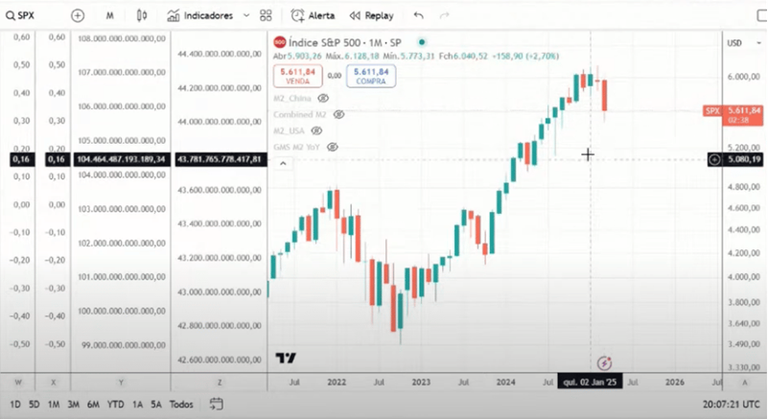

Despite the tense atmosphere, Monday's closing was “ok”: The S&P500 closed the month down, but rose 0.55% on a daily basis.

BTC closely followed Nasdaq's movement once again, showing that investors in the American stock market (and also in Bitcoin ETFs) are pulling the strings.

BTC ended practically at zero to zero, despite the negative vibe of the day.

**But what can change the game? **

Trump. His words should dictate the rhythm of the week.

Furthermore, when the Japanese investor goes into “sell everything” mode, there is not even any left for BTC. But... don't worry, there's good stuff behind the scenes

Strategy issued more debt to buy 22,048 BTC at an average price of $86,969

Institutions and large funds are accumulating BTC with everything!

Gamestop set aside no less than 1.3 billion dollars for this, through the issuance of debt. It will be your first Bitcoin purchase.

Marathon, a mining company listed on the US stock exchange, is also expected to enter heavily — with more than 1 BI in BTC

And then you must be wondering… so why doesn’t the price go up?

Simple: we are going through a phase of global liquidity contraction, full of uncertainty and fear of new tariffs. But if you think you can only make a profit when prices are high, you're wrong!

Posted Using INLEO