Silver’s 18% Drop Threatens Bullish Trend

Other than my weekly silver portfolio review on the weekend I don't really look at silver's price during the week. However, I opened a SLV position last month as a means of hedge against Trump's tariffs. Currently, that hedge is not working out so good. Why you may ask, silver's sharp breakdown from a rising wedge led to an 18% drop, breaching key support levels and raising the risk of a bearish trend reversal as the shiny metal is not offering much protection.

Technical Analysis

Silver broke down from a rising bearish wedge last Thursday and fell hard. The technical break plus the geopolitical and economic landscape was the perfect trifecta for silver to reach a low of $28.32 on Monday before there were signs of support leading to an intraday rally. At the low, the price of silver was down by $6.27 or 18.1% from the recent trend high of $34.58 in only six days.

This decline undercut a prior interim swing low of $28.75 from December thereby triggering a potential trend reversal signal. However, until there is a daily close below that low, the breakdown and potential bearish reversal is not confirmed. For me I like to look at support levels and during the decline there were several key potential support levels that failed. The 20-Day MA,50-Day MA, and the 200-Day MA were all broken which I don't think I've ever seen such a fast decline. I think there is more pain ahead but I'm waiting for tomorrow as tariffs go into effect at midnight.

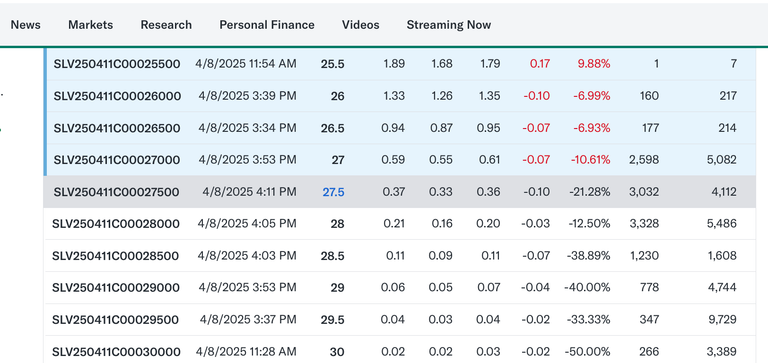

The only saving grace has been with increase premiums on options I have been selling 1DTE covered calls for about $45 of extra income a day. My SLV long tock is down about $500, but I'm a little over even with the premium I have been collecting.

For 4/11 you can get the $27.50 strike for $0.37/contracts!

You received an upvote of 36% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Nah. All markets got pounded because of the stock market. They sold off to pay margin calls.

At last there is opportunity. Thinking of buying a few ounces of silver. Everything else is too expensive !

Oh dang, I didn't even see that. I might need to head over to the bullion store!

Everything was not spared in the vanishing of market liquidity. This week saw my conservative Retirement holdings take a $13k haircut. It's survivable. Now to plan my next PMs DCA Buy.

!BBH

I heard Trump wants 104% tariffs on China, srsly we need more dump on markets? Everything will keep going down

Stack more you won't regret.

HOld tight, you will see a sharp rise soon.

Intense fall. Good thing is that at least the covered calls are helping a little. It'll be a nice investment to grab some physical silver if it keeps falling

Shopping is done here because tariffs will not be imposed for three months

The market is really suffering but I am so sure it will definitely recover very soon.