GambleFi Portfolio | Why I Doubled Down on SBET!

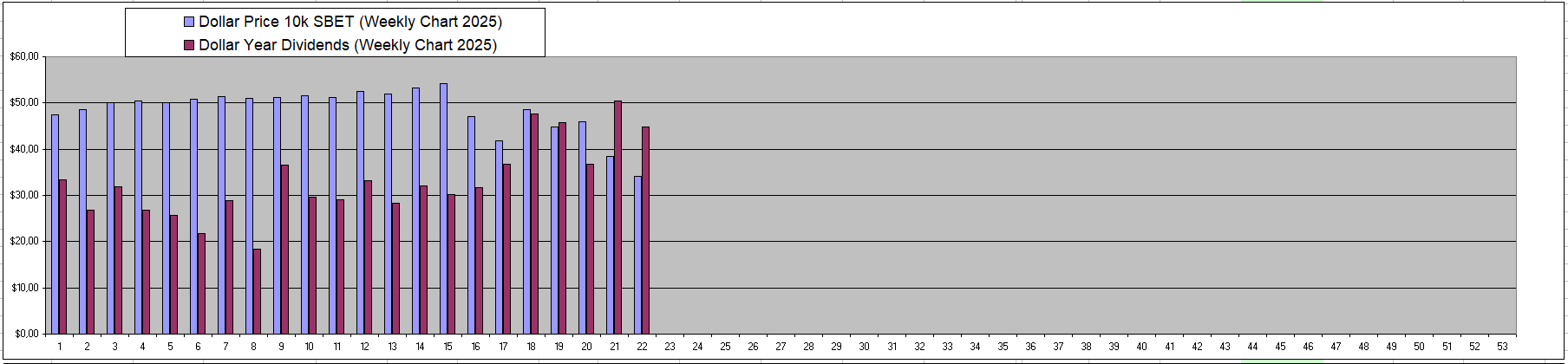

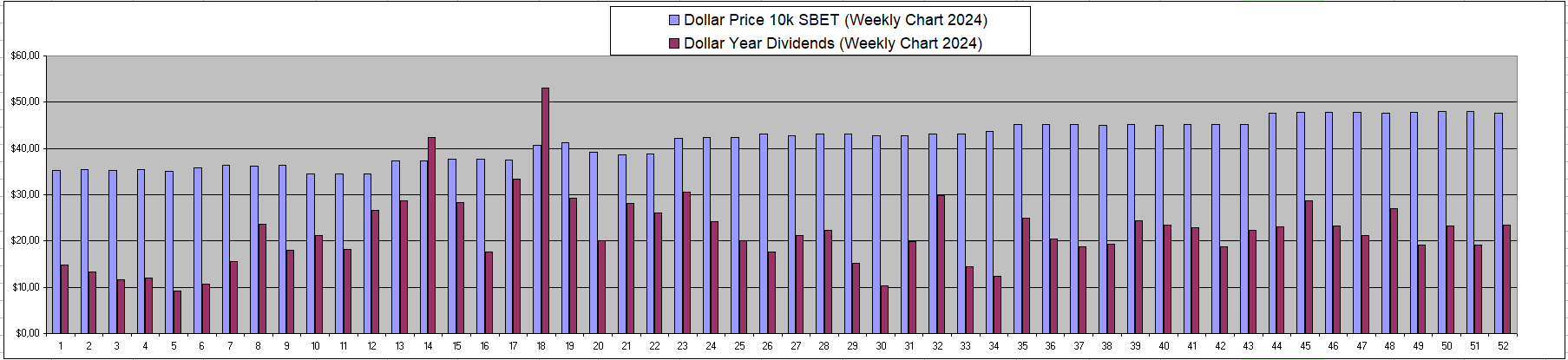

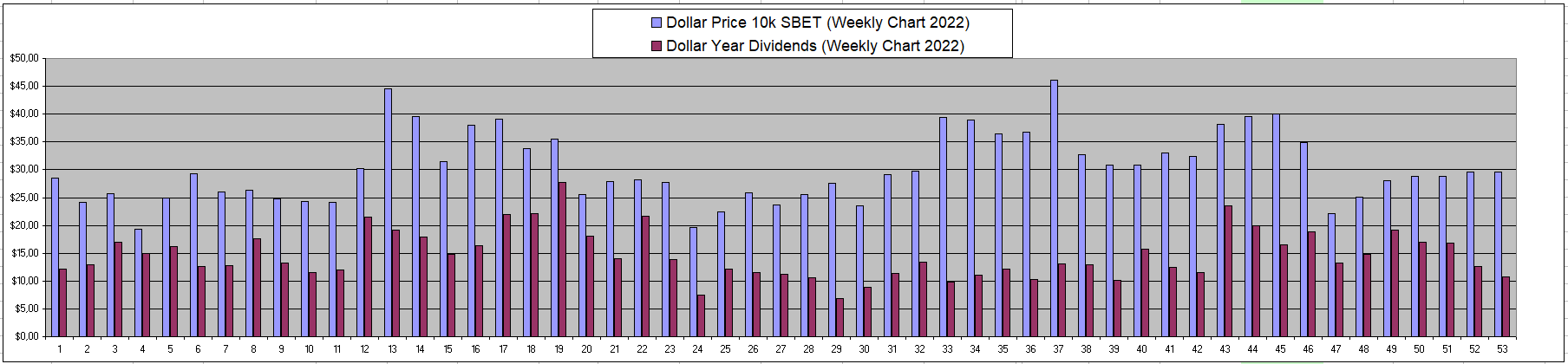

When it comes down to my GambleFi Portfolio, SBET has been my biggest position and best most consistant performer in the past 5+ years. It never really pumped that high but also held up during the bear market. Overall the numbers have been going up while the 2nd biggest holder started to get out of his position while there is low liquidity which pushed the expected returns above 100% APY yearly. This made me pull the trigger to double down on my already overexposed position as a calculated gamble I hope won't backfire on me.

Reasons I Fomo Bought More Sportbet.one (SBET)

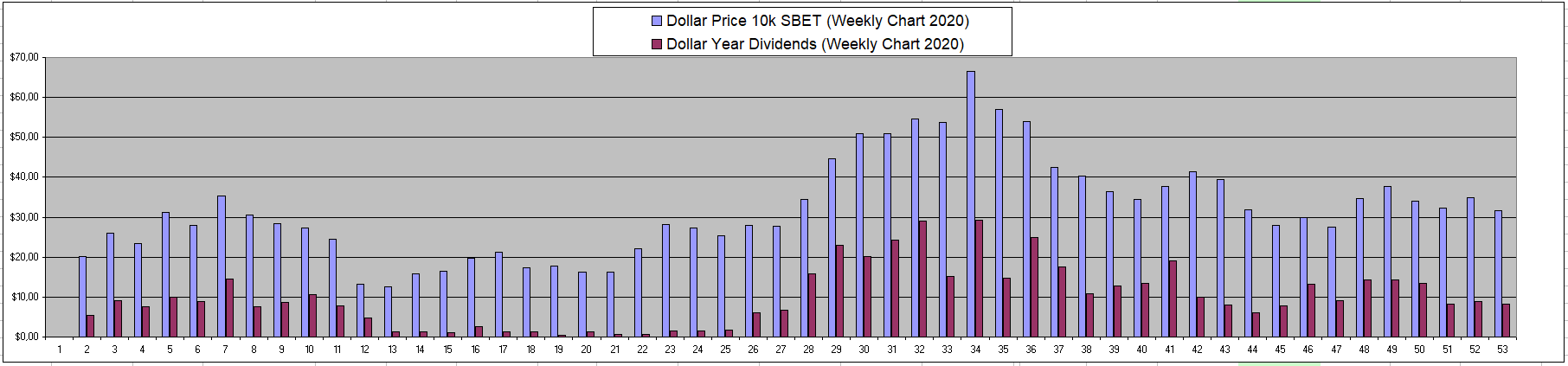

- 5+ Year Flawless Trackrecord: It's something I experienced first hand for the last 5+ year how SBET has been a dividend machine which is just extremely reliable.

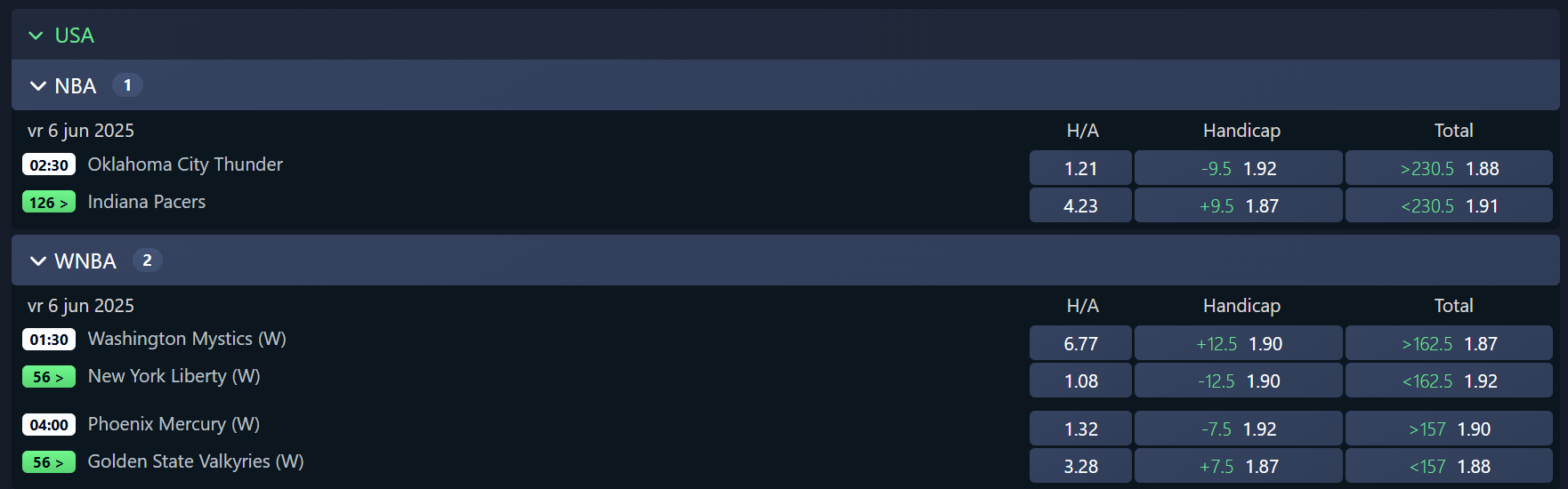

2025 Results So Far

2020-2024 Year Results

Battle-Tested : Over the years they have suffered 2 hacks but each time it was handled properly and there was more than enough backup to have it covered while the dividends never stopped coming. I would say that this makes them more prepared for things like this and for it to be less likely to happen again. In case it does, they already showed 2 times that it was no issue.

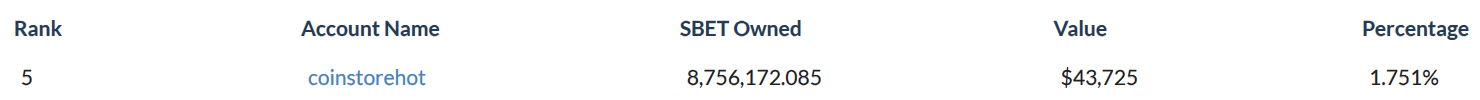

Devs Rely On Token for their Earnings: There aren't too many projects where it's the case that Devs and holders are in the same boat. Sportbet devs hold 73.5% of the supply and have it staked to receive earnings from the platform themselves. The price of the token doesn't matter so much to them as they are not looking to dump.

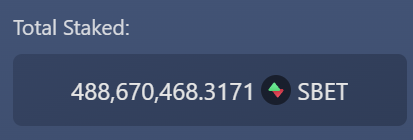

98% of Circulating Supply is Staked: With many of the projects only a small part of the supply is actually staked to get their part of the earnings and a constant inflation is pushing down the returns over time. For SBET 50% of the supply is in circulation and 98% of that is staked. Half is still owned by the team but will only be released partially when new developments come. Last time that was 100k extra SBET when they moved to a new exchange with part of that going to the market maker. They have shown that they can be trusted with this supply and in the worst case it just doubles overnight still giving ok dividends.

Cheap Price: as the price of 0.0054$, the 2nd biggest account who owned 19 Million started getting out of his position fat finger selling in 1 click which pushed the price down while some of the other bigger holders increased their position also 1-click buying with a fat finger pushing the price back up. Howevern it's possible to stealth buy a lot without pushing the price up. Currently at 0.003635$, the fully diluted market cap is only 3.6 Million while they do generate quite some revenue.

Low Exchange Liquidity Right now there is only 8.7 Million SBET 'available' on the exchange with 2.1 Million more still in the account of the dumper. So it's impossible to really buy a big position while most holders including myself have no intention to sell. Most of the bigger holders also added to their position at these prices. At some point, the liquidity will dry up which should make the price go higher.

Easy Onboarding: It's actually very easy for someone to use the Sportbet.one site with no KYC or VPN needed. You can use your social logins and they accept many different currencies playing into many of the different altcoin cults. Anyone with Solana, XRP, Cardano, Doge, Tron, TON, Bitcoin Cash, Trump, Shib.. can easily deposit and withdraw money and start betting with all the blockchain stuff happening in the background with all cost covered.

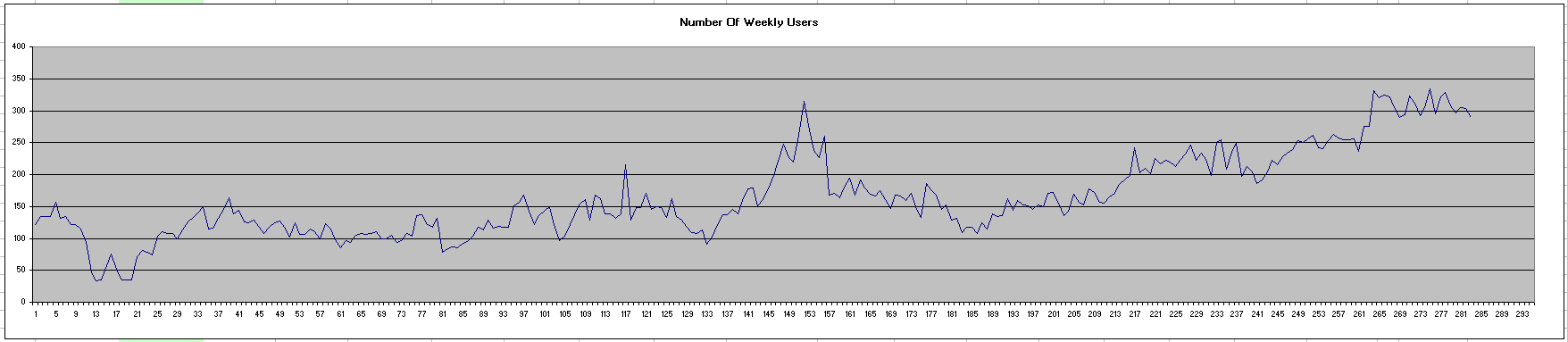

Growing Userbase: I have been tracking the numver of weekly active users which shows a steady uptrend over time and there is no real reason why this would not continue. Right now they have around 300 active individual users weekly who place bets.

Expected Dividends: Dividends are paid out in the different tokens based on the betting volume so they are stable week after week taking some from the good weeks to cover for the weaker weeks 9M Stakes SBET last Monday gave close to 800$ in earnings for the week which equals ove 100% APY at the current price.

Reasons To Possibly Worry

No Idea Why Whale is Selling: There are different possible reasons why someone might want to get out despite the fact that things look quite good. One of them is that he or she knows something is up that isn't clear to everyone yet.

Centralization: While everything runs on the Blockchain and can be checked, all funds and tokens need to be deposited to the devs wallet who then give 'fake' tokens on the EOS chain for convenience. So in theory they could just rug the entire thing and run away with all deposited money or they can get hacked again somehow. However, their trackrecord so far has been pretty impressive so I feel that is rather unlikely

Regulatory Issues: In the end, they are running a casino without any KYC or restrictions with a token that gives a revenue share. So there is a risk that as some point regulation could become an issue.

Mediocre Odds: Sportbet even though at times they have nice offers remains a rather high juice bookmaker making it so that they do have to rely on players willing to put up with that.

Conclusion

: The 5+ Years of flawless running of Sportbet always receiving reliable a good dividends made me double down now at a time when the price is low because one of the whales is getting out. It's not without risk but I'm willing to take.

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using INLEO