GambleFi Portfolio | Still Grinding Good Dividends...

It's been a while since my last general update on my GambleFi Portfolio, and I'm still grinding out dividends week by week which mainly come from SBET which has been one of the most reliable ways to get returns in crypto these past 5 years. I'm just bringing a basic update on the numbers of each of the projects I am or was invested in.

Sportbet.one (SBET)

SBET still feels like it's dirt cheap after one of the whales got out. That same whales started to get in again but soon after dumped again so I'm not quite sure what's up with that. With the football leagues starting up again along with soon the NFL Season, volumes should go up along with that. Last 3 weeks, the returns based on the price have been 61.67% / 93.96% / 69.73% and I'm tempted to add another Million SBET to my holdings.

These were the dividends I received last week...

WINR is still kind of stuck in the same loop as bugs or exploits that pup up make the site go into maintenance which kills the momentum. They are putting in effort to increase the volume with a Weekly race. However, the prizes are paid in WINR so it adds inflation and selling pressure. The price is not far away from the all-time lows and a 5 Million Market Cap while the returns with 20% of the supply staked are somewhere between 6% and 22% APY.

All this said, I still see WINR as an ok risk/reward bet as they did build a project with potential that kind of works and more things on the horizon. The fact that ETH is alive again also helps. I do see this as a project though for the next cycle and I'm considering adding to my holdings a bit at current price level.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

It looks like the peak fud some time ago marked the bottom, I'm glad that I didn't dump but waited for the price to recover to sell my holdings. The main metric remains the yearly burn % which last week was at 27.768% of the supply. Fundamentally, this one still looks cheap, but the main issue is that the team has shown they can't really be trusted.

Betfury.io (BFG)

I'm actually glad that I swapped my BFG for more SBET as things haven't really looked that good. The dividend pool and the APY (which takes a full year of locking to get them) have gone down.

So basically the key metrics keep going down and at a APY of just 26.38% APY which requires a year of Locking, BFG is nowhere close to the point where I would be willing to invest in it.

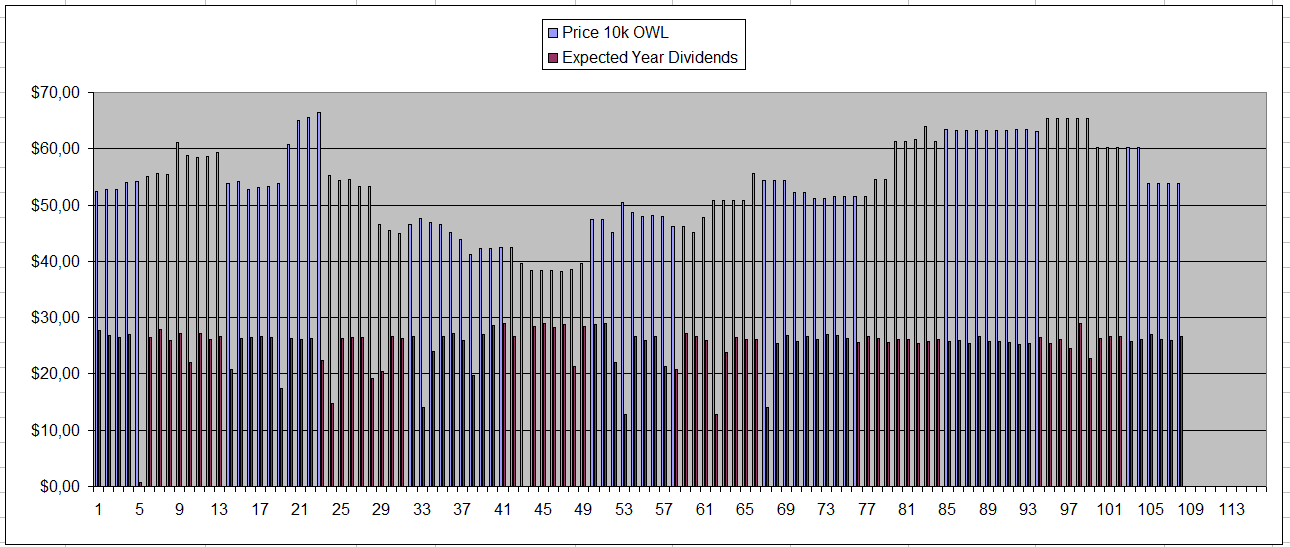

Owl.Games (OWL)

Pretty much no news or anything from Owl for years and it remains the same pattern that dividends remain the same around 50% APY but at the same time the liquidity pool seems to be gone so it's not possible to buy or sell. By now I earned 2980$ in dividends after being invested for 109 weeks while it cost me 3179$ to buy my stack. So I'm about 93% far in earning back what I put in but with no clue if it's actually possible to sell my bag.

I pretty much keep this running while occasionally plating some poker on their site. I withdraw each time the funds earned start to add up and will see were it all goes.

Solcasino.io (SCS)

Solcasino also still faces the same issue in that they kind of ignore the USDC Pool which is by far the most important factor. At least now after a big burn, 40% of all tokens are staked and the expected returns are around 25%. This is simply not enough given that there is a 2% burn for locking and also some for unlocking if you do it too quickly. Basically the only way for things to go up is if they increase the USDC Pool.

Sx.Bet (SX)

SX is also still facing the same old problems is that their token is totally disconnected from the project since the fees are turned off. So all anyone is really getting is part of the inflation. The only thing that holds the price up is speculation for future revenue share. At the same time, in case fees would be turned on it might killl all action.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +70% APY |

| Betfury.io (BFG) | +26% APY |

| Owl.Games (OWL) | +50% APY |

| Sx.Bet (SX) | +8% APY |

| WINR Protocol (WINR) | +9% APY |

| Solcasino (SCS) | +25% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

I earned 442$ in dividends last week for holding and staking 15M SBET | 600k OWL | 28.5k SX | 12M WINR | 1M SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|