Are Liquidity Pools worth it? SPS/HIVE to be specific!

Our story begins in A long time ago in a far away land...

(Read: A month ago in my Discord Server)

I was talking about Liquidity Pools and the SPS/HIVE one on TribalDex and @nozem01 told me they are worthless because of "Impertinent Loss" or something like that anyways. It was on that day that I decided to start tracking my SPS/HIVE on TribalDex to see just in fact if it was worth it or if I was loosing $$ because of it.

And now after enough data has been collected, I can write a article about it to inform you all of my findings 😁

Where We Started From?

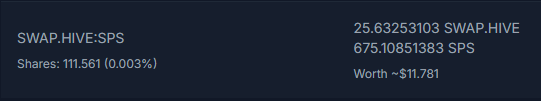

On June 12th, 2025 I took a screenshot to start my documentation Journey!

For our sake I am going to call this my starting point. I started with:

25.63253103 SWAP.HIVE

675.10851383 SPS

Worth $11.78

Also throughout this article I am not going to take into account swap fees and all that. It's too much for my little brain to compute and honestly to me Liquidity Pools are long term investments anyways so after say 2 years you are only making a 1% profit, any fees for swapping are going to negate that. I think if there is a profit of at least 5% that would be bare minimum for it to be worth it.

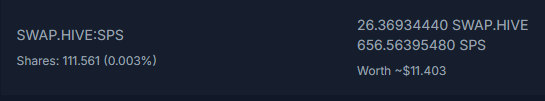

June 15th

26.36934440 SWAP.HIVE

656.56395480 SPS

Worth $11.40

June 29th

25.13572366 SWAP.HIVE

690.13640893 SPS

Worth $10.32

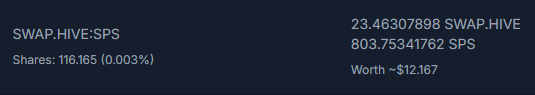

July 21st

23.46307898 SWAP.HIVE

803.75341762 SPS

Worth $12.17

July 22nd

23.36557884 SWAP.HIVE

807.32078517 SPS

Worth $12.14

Impertinent Loss?

I started this journey with $11.78 worth of staked tokens (but that $ value is at the cost those tokens were on June 12th when I started).

25.63253103 SWAP.HIVE

675.10851383 SPS

I ended this journey with $12.14 in staked tokens. But again that means nothing. What is relevant though is if I take the tokens I had staked on June 12th and see what just holding those tokens until now would be worth.

And if we do that we get...

| Token | Amount on June 12th | Value on June 22nd | That Value in $$ |

|---|---|---|---|

| SPS | 675.10851383 | 19.28791775 Hive | $5.00 |

| Swap.Hive | 25.63253103 | 25.63253103 Hive | $6.65 |

So that is $11.65 worth of tokens in today's value that I had staked back on June 12th.

And currently

| Token | Amount on July 22nd | Value on June 22nd | That Value in $$ |

|---|---|---|---|

| SPS | 807.32078517 | 23.06523556 | $5.99 |

| Swap.Hive | 23.36557884 | 23.36557884 | $6.06 |

So that is $12.05 worth of tokens that I have staked TODAY and it's value today.

That means just as face value the amount in my Liquidity Pool has grown in $0.40 since June 12th. That is a 3.4% increase/profit.

So take that @nozem01 for your "Impertinent Loss"!

But Wait There is MORE

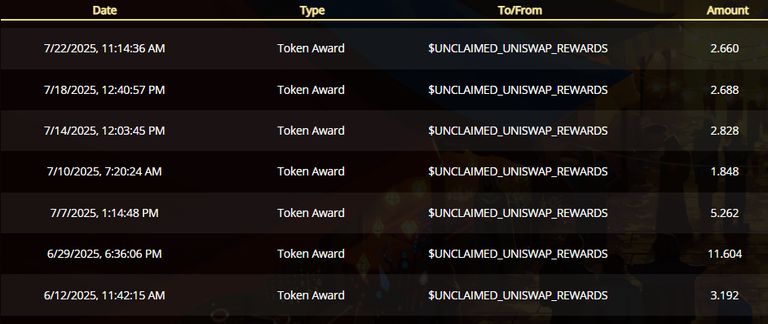

That is only half of the story. We haven't even talked about the SPS rewards you get for staking in the SPS/Swap.Hive Liquidity Pool!

That's right! There is even MORE profit to be had.

Below is a screenshot of all the SPS withdraws/claims I made from just the Liquidity Pool. The very bottom one is on June 12th and that was claimed RIGHT before I took my first screenshot to start this journey so I could start with a clean slate.

That 26.89 SPS is worth 0.76824999 HIVE today or $0.20 at today's value.

So before I said that I started with $11.65 in today's value of tokens back on June 12th.

I earned $0.20 from the SPS rewards.

I earned $0.40 from the staked token amount growing.

Which is a $0.60 profit or 5.2% profit after a little over a month.

Final Note & Considerations

This is also not taking into account that the SPS rewards I earned for using the Liquidity Pool, I then stake in Splinterlands. So I earning Vouchers and SPS from those profits being staked. You could reinvest those SPS earnings back into the Liquidity Pool (which is what I normally do but didn't want to make this experiment harder than it was.

This is just MY personal experience over the course of a little more than 1 month. So your mileage may vary and my mileage my vary.

I have not tracked the staking rewards for just purely staking SPS in Splinterlands. It may be better to convert my Swap.Hive to SPS and then stake all of it into Splinterlands. I don't know. But what I do know.. is that I like spreading out my funds. It may not be the best financial gains possible but it requires less brain power on my part and reduces my risk should anything bad happen.

What else did I miss? I am sure there is something I am overlooking....

TLDR - Is It Worth It?

The answer to me is YES! I made a okay 5.2% profit from staking a little over $10 worth of SPS/HIVE into the Liquidity Pool. Could those rewards be better? Yeah. Could they be worse? Yeah.

So all in all I will take a free 5% any day of the week!

|  |

|---|

Yeah well I'm still not touching LP's 😁

🧠 What Is Impermanent Loss?

Impermanent loss happens when the price of the tokens you've put into a liquidity pool changes compared to when you deposited them. The bigger the change, the more you're exposed to impermanent loss.

It's called "impermanent" because the loss only becomes permanent if you withdraw your funds from the pool when prices are still imbalanced.

📊 Example:

Suppose you provide liquidity to a pool with two tokens: ETH and USDC (a stablecoin), in a 50/50 ratio.

You deposit:

1 ETH (worth $1,000)

1,000 USDC

Total value = $2,000

Over time, ETH price doubles to $2,000.

To maintain balance, the pool automatically rebalances your assets (using an algorithm called constant product). This means:

You now hold less ETH, but more USDC.

If you withdraw now, your total value might be less than if you had just held the ETH and USDC outside the pool.

That difference is your impermanent loss.

That sounds like a lot of ChatGPT NONSENSE!

But also that makes a lot of sense too, and fair point. BUT since prices of any Splinterlands things only go up.. It's a win win ;)

Yeah it was totally ChatGPT but still true 😁

I also like lp we can earn thru fees especially those with high apr. And yes the problem is the impermanent loss. How much apr do you get in tribaldex?

Here is the advertised APR for the 3 pools on TribalDex

Oh I see, its around 15%. Thanks @cherokee4life.

yeah of course! happy to help

Azircon made some great posts about this, two actually. There is a range where you can actually make money, but only up to a certain level. If both tokens rise in value more or less the same, it's also profitable. It depends on what expectations for the future are - I'm doing a little digging into pools as well, but shit-coin-pools. Will publish an article about it, soon :-)

https://peakd.com/hive-169191/@azircon/resource-pools-and-asymmetric-risk

https://peakd.com/hive-180505/@azircon/option-strategy-selling-a-straddle

@cherokee4life, I paid out 0.050 HIVE and 0.011 HBD to reward 1 comments in this discussion thread.