Slow and Steady: Utility Company Dividends

The childhood story of Tortoise and The Hare isn't just a lesson for kids. The same story can teach adults a few things about a way to approach investing. The story has many parallels as to how people invest. Personally, I prefer the "Tortoise" mentality of "slow and steady," specifically as it applies to dividends. Monthly, quarterly, and annual income for holding a stock is a great benefit, and there's one sector that tends to be the most stable: utilities.

(Created with Bing)

(Created with Bing)

Slow and Steady

Utility companies are boring, but for investors looking for predictable dividend payouts, that's exactly what you want. Yes, you also want growth, and a company actively expanding their infrastructure and bringing in new customers will do that slowly, year over year.

Resilience

An advantage utility companies have is the ability to withstand most economic downturns. Most people don't stop paying for their electricity, gas and water. You can only go without those for so long.

The Competitors

It's great to talk about companies that are "slow and steady" while demonstrating "resilience," but what does that look like?

If you're unsure where to start, Dividend.com can help. You can easily filter stocks based on certain parameters, such as only companies with a payout ratio between 35-55%. Why this specific range? It's a sustainable ratio that shows the company is still retaining capital for growth. (Source)

A quick search gives us some good, solid choices:

- NextEra Energy (NEE)

- The Southern Company (CO)

- Duke Energy (DUK)

Picking A Winner

You can't go wrong with any of these, but diversification is the name of the investing game. So how do you pick just one? It's best to remain objective and look at a few key indicators.

Volume: an indicator of general investor interest

Payout ratio: 35-55% is the general sustainable range for dividends

YTD Total Return: between dividend payments and stock price movement, this measures what investors have lost or gained in value from January 1st to present

As with all investments, you have to decide what you can afford to lose, how much volatility you're willing to ensure, and what your end goal is with the investments you're considering.

Utility company stocks won't give you the leaps and bounds in growth like the Hare, sprinting ahead at the start of the race. Instead, like the Tortoise, they'll give you predictable growth and a steady stream of income in the long-term.

Buy DUO and stake to receive Hive dividends, tip others, have your posts curated, and grow Hive!

https://tribaldex.com/trade/DUO

https://hive-engine.com/trade/DUO

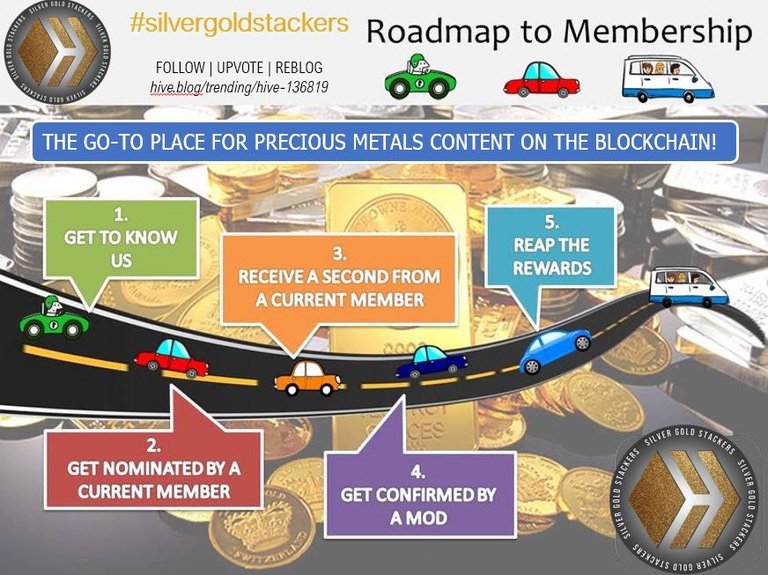

Do you like stacking gold and silver?

Are you new to Hive, or know someone new to Hive, and want help and support?

Have you been on Hive for a while and want to help new Hive members? Join HOC and help us grow Hive and encourage new members!

Posted Using INLEO

You received an upvote of 100% from Precious the Silver Mermaid!

Please remember to contribute great content to the #SilverGoldStackers tag to create another Precious Gem.

Wtf, 35-55% is a sustainable dividend? xD

Sounds insane and sounds like they are ripping off their consumers xD

You have to consider this ratio is the percentage of net income paid out to shareholders. There's a lot of money involved in maintaining gas and electric lines, in addition to needing to have funds to expand.

Most utility companies operate within that range. Too little and you'd have no investors. Too much, and you can't afford to even keep up maintenance costs, let alone expand.

!BBH

!PIZZA

!ALIVE

Ye sure and extra divs if the year is good, I get. But I still think its crazy if thats considered a sustainable dividend xD

$PIZZA slices delivered:

bulliontools tipped thebighigg

bulliontools tipped dlmmqb

thebighigg tipped bulliontools

@thefed(2/15) tipped @bulliontools

bulliontools tipped angeluxx

bulliontools tipped cwow2

thefed tipped cwow2

bulliontools tipped yusmelys

bulliontools tipped diegoloco

Please vote for pizza.witness!

Wait. If I look at their payout % its only in 3-5% ish.

I don't think I understand what you are talking about then xD

No it’s far less, COST Is half 1 %. Average it out it’s hardly 2%. Better be holding for growth with half a percent dividend, which is what COST holders hold for. for good dividends you can find 5% floor stocks that are very safe. I actually discuss my biggest holding in my recent Trad-Fi post. I bought at $29 when paying 10%. It’s doubled past 18 months and though only 5% plus for new buyers, this is a safe dividend play.

https://peakd.com/hive-143901/@thefed/one-of-my-best-value-stocks-right-now-why-i-continue-to-hold-bti-for-income-and-long-term-value

Utilities are a racket with guaranteed profits. Diversify and you will come out with some nice returns, I agree!

!PIMP

!PIZZA

!BBH

Yeah, sadly there's no way to really avoid a monopoly. Fortunately, the state utility commission typically keeps them in check, but I know that's not always the case everywhere.

!BBH

!PIZZA

!ALIVE

!DOOK

!DUO

You just got DOOKed!

@bulliontools thinks your content is the shit.

They have 2/400 DOOK left to drop today.

Buy more DOOK here - smell ya later💩

You just got DUO from @bulliontools.

They have 1/1 DUO calls left.

Learn all about DUO here.

I prefer slow but steady wins the race. I love your analysis and how easily you present it. I understood it perfectly and it seems like excellent advice. I'll keep it in mind for the future. Thank you.

Thanks! I'm glad you liked it! I appreciate you taking the time to read it.

!BBH

!PIZZA

!ALIVE

isn't that what sounds as pakx? I am already working on graphs so it's easier to understand by visual representation.

It does. Why do you think I invested into it? 😉

Keep up the great work with it!

!BBH

!PIZZA

!ALIVE

They depend heavily on the politics of the country where they operate.

In Argentina, the fate of your investment depends on the government in power. They can implement consumer subsidies, freeze rates, or expropriate the company. I live in Argentina. Currently, the government is only interested in raising rates so the State stops paying subsidies.

I'm sorry there aren't as many investments in your country. 🙁

Are you able to invest outside of it, or do they heavily control that also?

!BBH

!PIZZA

!ALIVE

You can invest in my country, but you have to be careful during times of crisis. There's also access to many stocks listed primarily in the US and Europe through programs similar to ADRs.

I have friends who left America to move to Argentina the investments are so good right now. The reason the libertarian government who came to power years back raised rates so high is to save the currency, I have 50K invested myself with Doug Casey’s company private listing now worth 110K in 3 years time. Obviously it’s a concern in a communist government comes to power again years from now, but complaining about raising rates only fine to save the currency is short sighted no? @diegoloco ? It’s a miracle you got a libertarian administration after decades of 100% plus inflation and no growth. This current climate is prime for making investments, you needed the currency to become more stable and that’s why rates needed to go up. I know Americans who moved there just for opportunity and has owned property there as investments anmong biz investments and watched it thrive the past 3 years. You have the best opportunities in all of South America right now,. There will always be fear of fall back to a leftist communist dictatorship coming back one day, no doubt that’s legit longer term concern, but there are Argentina individuals making the best investments of there lives right now with a administration finally fighting inflation and saving the currency among getting rid of the previous administrations anti biz & freedom policies. You really want a return to lower rates and for currency to go into hyperinflation again? The opportunities are once in a lifetime type with a administration finally going anti communist and pro capitalist. It’s not risk free but here in America I’m watching Americans move there for opportunity not other way around which is wild and amazing. Obviously it is painful to stop inflation after decades of corruption & anti capitalist administrations, but that’s only way to change things for long term. Saving the currency is longer term the most amazing thing ever. I’m likely planning to return to visit in late 2026 or 2027, we should grab lunch.

I follow Doug Casey fod years. He’s living full time in Argentina right? I’m not invested but I listen to his podcast. He’s been telling all his listeners to move to Argentina for the great opportunities! I agree rates going high to fight inflation isn’t something to look down on, without a stable currency there’s nothing. But just like here in America, there’s always many who don’t understand this stuff. I wish we had a chance at a libertarian president who actually had the power to cut spending like Argentina admin has. It would bring in massive amounts of positive growth and reduce risk. But even Trump who’s bot cutting anything making a real dent, the media cries about government spending being cut = dead poor people. Just ridiculous propaganda! I would love to see a real libertarian elected here in America along with a supportive congress. Trump and his hardly make a dent cuts didn’t Steve have support of most the republicans. It’s just all corrupt politicians who wanna spend until we are destroyed as a nation.

I plan to invest when I'm an adult and have a formal job, and this advice is fantastic. I'm learning a lot here; I'll have to research this topic—it's great.

It gets even better when you reinvest the dividends, because you're essentially compounding over time.

!BBH

!PIZZA

!ALIVE

These are not good dividend plays. Nobody holds COST for a half a % dividend a year. They hold for growth.

DUK - 3.37% a year

NEE - 2.72%

COST - 0.51%

These were examples, although I have no clue where you got "COST" from.

There are alternatives if you're looking for growth and dividends. It all depends on your goals.

!BBH

!ALIVE

!PIZZA

!LADY

View or trade

LOHtokens.@thefed, you successfully shared 0.1000 LOH with @bulliontools and you earned 0.1000 LOH as tips. (1/10 calls)

Use !LADY command to share LOH! More details available in this post.