USDT vs. USDC: the Two Leading Stablecoins

Stablecoins like Tether (USDT) and USD Coin (USDC) aim to maintain a stable value, typically pegged to the U.S. dollar.

USDT (Tether)

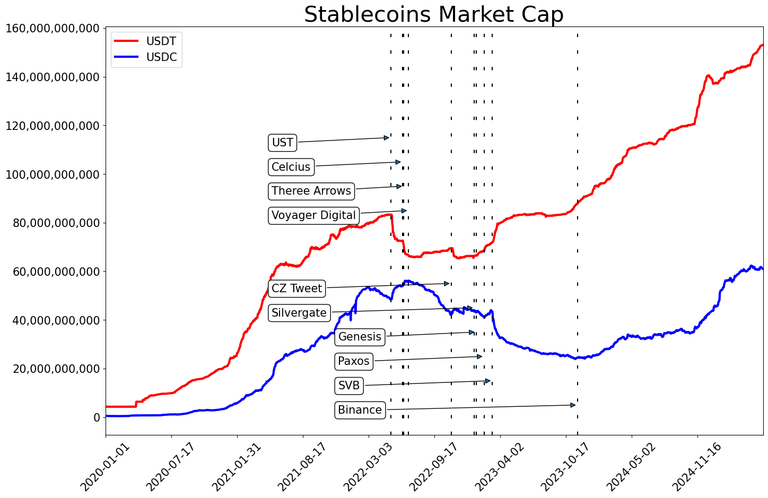

Launched in 2014 by Tether Limited, USDT was one of the first stablecoins. Initially built on Bitcoin’s Omni Layer, it has expanded to multiple blockchains, including Ethereum, Tron, and Solana. USDT maintains its 1:1 USD peg through reserves, primarily cash, cash equivalents, and other assets, though its reserve transparency has faced scrutiny. Tether has grown to dominate the stablecoin market, with a circulating supply exceeding $150 billion as of 2025.

USDC (USD Coin)

Introduced in 2018 by Circle and Coinbase, USDC is a newer stablecoin emphasizing regulatory compliance. Built primarily on Ethereum, it also supports other blockchains like Solana. USDC is backed by fully audited reserves of cash and U.S. Treasury securities, with monthly attestations enhancing trust. Its circulating supply is around $60 billion as of 2025. USDC’s development prioritizes institutional use, partnerships with financial entities, and integration into regulated financial systems.

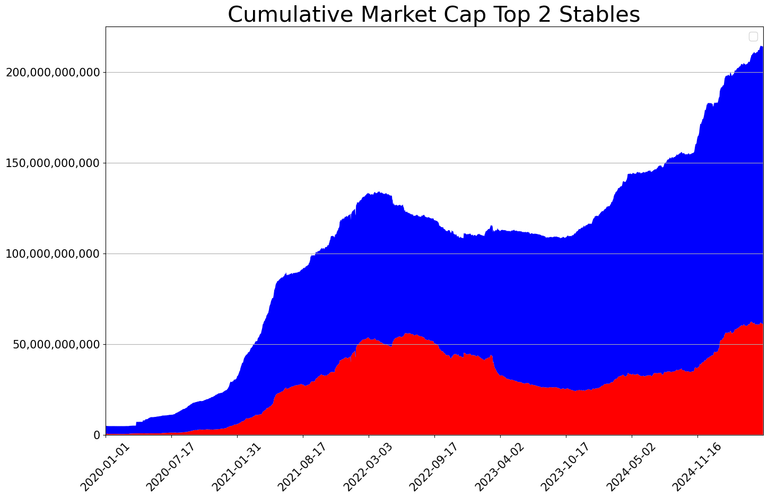

Market Overview

The combined market cap of USDT and USDC is around $210 billion, ranking them collectively near the 62nd largest company globally by market value. After a volatile period from mid-2022 to late 2023, both stablecoins have seen steady market cap growth since 2024, reflecting increased adoption and stability in the crypto market.

Key Events Impacting Stablecoins (2022–2025)

The following events have shaped the crypto and stablecoin markets, with notable impacts on USDT and USDC:

- UST - 09.05.22 – Depegging of UST (now USTC)

- Celsius - 13.06.22 – Celsius suspended customer withdrawals

- Three Arrows - 16.06.22 – Hedgefund failed to meet margin calls

- Voyager Digital - 01.07.22 – Voyager Digital suspended customer withdrawals

- CZ Tweet - 06.11.22 – Binance CEO announced to sell all FTT tokens (native currency of FTX)

- Silvergate - 05.01.23 – Silvergate’s depositors withdraw over $8 billion in funds

- Genesis - 20.01.23 – Genesis files for Chapter 11 bankruptcy

- Paxos - 13.02.23 – The SEC sends a Wells Notice to Paxos (the issuer of the Binance USD stablecoin on Ethereum)

- SVB - 10.03.23 – bank run on Silicon Valley Bank

- Binance - 21.11.23 - $4 bln fine for Binance

Daily market data from coingecko

https://www.reddit.com/r/CryptoCurrency/comments/1l1mndp/usdt_vs_usdc_the_two_leading_stablecoins/

This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

STOP

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @bluerobo, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!We love your support by voting @detlev.witness on HIVE .

View or trade

BEER.Hey @bluerobo, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @bluerobo, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.