The Cost of Hesitation - A Lesson in Crypto Investing

Last month, after I read about the development of Leodex, the decentralized exchange for the $LEO token tied to the INLEO platform, I was optimistic about the future of the token and I even moved some quantities of my token to Leodex. It was glaring that the utility for the LEO token will eventually grow. At just 2 cents per token, it felt like a steal, a small bet on a project with a vibrant community and a rewarding ecosystem. I bought in, excited about the potential, but cautious with my lean budget. I told myself I’d wait for a dip to stack more LEO. After all, crypto prices are volatile, right? Dips are inevitable.

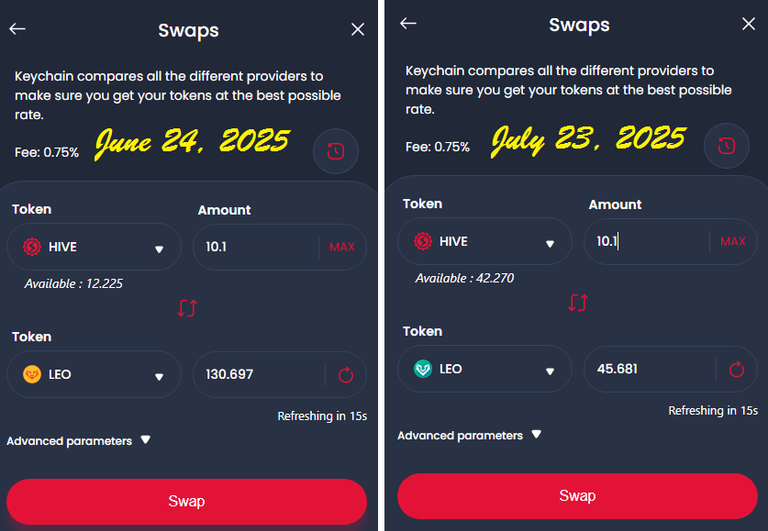

Fast forward to today, and LEO is trading at 6 cents. My modest investment has tripled in value, which feels like a win. But there’s a sting in this success. My plan to accumulate more LEO, at least 1,000 before the launch of the staking feature on Leodex at a lower price has been derailed. The price surged faster than I expected, and my hesitation have left me sidelined. I have been watching the opportunity slip through my fingers. This experience has taught me a timeless lesson waiting can be risky.

The LEO Opportunity and My Misstep

When I first encountered LEO, I was drawn to INLEO’s vision of rewarding content creators and community members with tokens. The platform’s focus on decentralized social media and user-driven content felt fresh, and the token’s utility within the ecosystem gave it real-world value. At 2 cents, LEO seemed undervalued, a hidden gem in the noisy crypto market. I bought a small stack, but my budget was tight, so I decided to wait for a better entry point.

In hindsight, waiting was a gamble I didn’t fully understand. Crypto markets do not follow predictable patterns all the time, and projects like LEO, backed by an active community, visionary leadership and great utility, can gain momentum quickly. Within weeks, the token’s price tripled, driven by growing adoption and market enthusiasm. My plan to “buy the dip” backfired, not because the market was unkind, but because I underestimated the speed of opportunity in crypto.

There is the Risk of Waiting in Investments

My LEO experience is a microcosm of an investment lesson that timing the market is a dangerous game. We should be wary of this in crypto, stocks, or real estate. Sometimes, waiting for the “perfect moment” could lead to missed opportunities. Markets move on catalysts, that is, community growth, technological advancements, or macroeconomic shifts. These factors are not always predictable.

For LEO, the catalyst was likely the new model of LEO called SIRP and the proposed staking feature on Leodex, which will pay users with IUSDC. It looks like there is also an increasing traction of users and engagement on INLEO with many willing to pay for the premium subscription priced at $10 but with a far-reaching value to the subscriber and the community at large. These and more are incentivizes for holding and staking.

This is not to say waiting is always bad. Dollar-cost averaging, for instance, is a solid strategy for mitigating risk. But when you’re working with a lean budget, as I was, every cent counts. Hesitating to act on conviction can mean paying a premium later, or missing the boat entirely. In crypto, where volatility is the norm, waiting can feel like chasing a runaway train.

Here is the summary of my hard-earned lessons:

Trust Your Research, Act on It: I saw value in LEO at 2 cents but did not fully commit because of budget constraints and hope for a better price. If you believe in a project’s fundamentals, allocate what you can afford and don’t overthink the timing.

Volatility Cuts Both Ways: Crypto’s price swings can be gut-wrenching, but they also create opportunities. A 3x jump like LEO’s is a reminder that small investments in promising projects can yield outsized returns.

Budgets Don’t Define Opportunity: Even with a lean budget, I could have bought more LEO incrementally instead of waiting for a dip that never came. Small, consistent investments can add up over time.

Community Matters: LEO’s rise wasn’t just about price, it was about LEO’s growing ecosystem. Projects with strong communities and real utility often defy expectations. Paying attention to these signals can guide better decisions. Sadly, I had missed from engagement in the community in the last 2 to 3 weeks.

As I write this, I’m still excited about $LEO, INLEO and LEODEX. The price may be higher now, but the project’s potential remains strong. I’ve adjusted my strategy, setting aside a small portion of my budget to buy LEO gradually, regardless of short-term price swings. It is not about catching the bottom, it’s about being part of the journey.

Here is a Word for Fellow Investors

If you’re reading this with a lean budget and big dreams, my story is a reminder that hesitation can cost you. This could be applicable to LEO or another investment. Do your homework, trust your instincts, and act within your means. Waiting for the “right moment” might feel safe, but in the fast-moving world of crypto, it is often riskier than jumping in.

The next time I spot a gem like LEO, I won’t wait for the stars to align. I’ll take my shot, however small, and let the market do the rest. After all, in investing, the biggest risk isn’t always losing money; it is missing out on what could have been.

See a screenshot of the exchange of HIVE to LEO last month and today. The difference is hard to believe for a layer 2 token.

I am your Blockchain and Technology Journalist.

Posted Using INLEO

LEO hast gained quite some momentum lately. 📈👍🏻

The momentum is significant.